We shall see if the Fed has moved too slowly in easing monetary policy, as stocks sold off again the first day of seasonally weak September. But the current estimate for real Q3 GDP growth is 2%, while Q2 EPS growth was strong and the forecast for corporate profits through the balance of this year and 2025 is favorable. Consider The Goodyear Tire & Rubber Co. (GT) here, highlights John Buckingham, editor of The Prudent Speculator.

With cuts on the way (the futures market is showing the year-end 2024 and 2025 federal funds rates at 4.3% and 3.09%, respectively), the interest rate backdrop should be supportive of higher equity prices. Yes, we must always be braced for downside volatility, but we still prize our copy of Stocks for the Long Run!

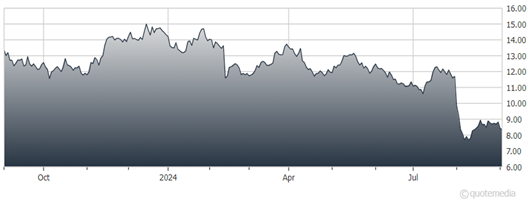

The Goodyear Tire & Rubber Co. (GT)

As for GT, it is one of the world’s leading manufacturers of tires, with operations across the globe. Despite a challenging industry environment, GT grew margins in Q2 with Segment Operating Income (SOI) reaching $339 million.

Management says it will expand profitable volume segments and promote cost reduction efforts through its Goodyear Forward plan. Goodyear recently announced the sale of its off-the-road business, marking a key step in its transformation plan. The company says it is committed to achieving its target of 10% SOI margins by the end of next year, with a continued focus on manufacturing efficiency, R&D, and retail operations.

We had hoped that the acquisition of Cooper Tire would be a game changer. But so far that has not been the case, even as replacement tires have typically offered more profitability and operating consistency. Still, with the stock off 38% year-to-date and consensus EPS estimates for 2024 and 2025 at $1.03 and $1.48, respectively, we can’t help but find sufficient upside to warrant buying at present levels.

Recommended Action: Buy GT.