For much of the past two years, there’s been one stock on nearly every investor’s lips: Nvidia Corp. (NVDA). So much so that I believe I’ve covered the chip maker more than any other. But there’s another rapid riser most investors have missed: Rolls-Royce Holdings Plc (RYCEY), advises Matthew Carr, editor of Tipping Point Profits.

There are brands that come to mind when we think of luxury...Gucci. Louis Vuitton. Chanel. Hermes. Cartier. Bentley. Ferrari NV (RACE). But if you’re of a certain age, Rolls-Royce is one that stands out as the peak of opulence.

Images of these bespoke cars gliding across city asphalt and country cottage drives as if on a cloud were the epitome of affluence for me as a kid. And they still are. The Silver Wraith, the Silver Cloud, and Silver Shadow were later replaced by the Phantom, the Wraith, and the Dawn. And the Wraith and Dawn have been shelved in lieu of Rolls-Royce’s new all-electric Spectre.

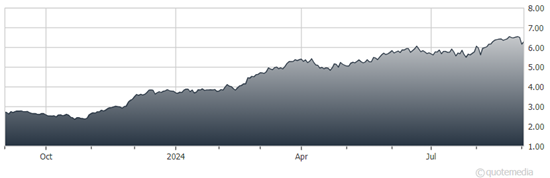

Rolls-Royce Holdings Plc (RYCEY)

Due to their staggering price tags, the 119-year-old company doesn’t have vehicles flying off the line. In fact, in 2023, Rolls-Royce produced a record 6,032 cars. That’s right...the biggest production year in the company’s history barely topped 6,000 vehicles. For comparison, Ford Motor Co. (F) slapped together 1,995,912 vehicles last year. And that wasn’t even a record for the Detroit powerhouse.

But it’s not cars that have sent shares of Rolls-Royce surging nearly 600% over the past two years. And the limited demand for its cars is not why it employs more than 41,000 people. The real luxury item it produces is engines.

In the first six months of 2024, more than 50% of the company’s $10.71 billion in revenue came from its Civil Aerospace segment. This was a 27% increase over 2023. More impressive though was operating profits from this segment surged 85%!

Rolls-Royce delivered 108 Trent XWB-97 engines in the first half of the year. These are designed for Airbus SE (EADSY) A350s. It also delivered 83 Pearl 700 engines, specifically designed for Gulfstream G700s and G800s.

Of course, shares of Rolls-Royce slipped in Tuesday’s US trading as Hong Kong’s Cathay Pacific grounded 48 Airbus A350s after an engine component failure. But it was noted, “This component was the first of its type to suffer such failure on any A350 aircraft worldwide.” The grounding was erring on the side of caution.

Rolls-Royce isn’t just in the skies…it’s in the seas, too. And here, Rolls-Royce engines power everything from tugboats to yachts. In the first half of 2024, $2.9 billion of Rolls-Royce’s revenue came from its Defense contracts. Most notably, this included an 84% increase in nuclear reactor demand for submarines.

Artificial intelligence and semiconductors have dominated investor mindsets for more than a year. But there are plenty of great companies, like Rolls-Royce, that are thriving as well…and their shares are outperforming those chipmaking champs over the past year.

Recommended Action: Buy RYCEY.