The Jackson Hole, Wyoming powwow for central bankers is behind us, and Fed Chairman Jay Powell didn’t disappoint markets. He said the time has come to start lowering rates, citing a softening labor market and inflation. We may get a correction in precious metals over the next few weeks, but I expect that will be a tremendous opportunity to load up on these assets, writes Peter Krauth, editor of Silver Stock Investor.

Powell thinks the Fed can pull off a soft landing. That would be surprising – almost shocking – as it has only happened once, in 1994. All other episodes of inflation have ended after entering a recession and high unemployment. Good luck Jerome.

Unemployment at 4.3% suggests things should look pretty good. It’s low on a relative basis. But that’s more than 100 basis points above where it bottomed at 3.2% last year. We’re in a clear uptrend, a shift which tends to happen just as the Fed starts to lower rates.

As much as the Fed is supposed to be apolitical, it surely can’t ignore the laws of economics…at least not completely, despite its secret wishes. The fact is, the US is drowning in debt, which is growing at a pace of about $1 trillion every 100 days.

That leads me to think the Fed is anxious to cut rates, despite inflation near 3% (officially) and while they continue to claim their target is 2%. This combination of sustained high inflation and falling real rates (interest rate minus inflation rate) are the ideal setup for precious metals.

The Fed is about to cut rates – bullish.

Inflation remains high – bullish.

There will be years of pressure on the Fed to keep rates low (to help pay interest on the debt) as the debt continues to soar – bullish.

This means we should expect the US dollar to remain weak for quite some time – bullish.

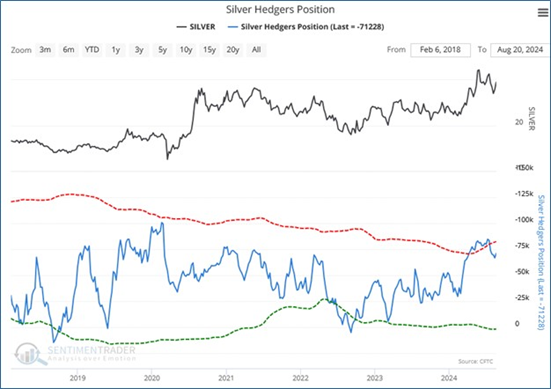

In the very near term, I continue to see silver (and gold) as potentially overbought. The bottom line is the positioning of “smart money” commercial hedgers in the futures market are still near peak short levels in the silver market.

In other words, they see silver prices as elevated and are overwhelmingly positioning for a drop. The last time their positioning was at such elevated levels was back in early 2020, when we saw a large, swift correction. I don’t know if that will happen this time, but the odds favor some sort of pullback.

That’s why I remain cautious in the near term. I continue to see overbought sentiment in precious metals and their related equities.

If I’m right, and we get a correction potentially over the next few weeks, I expect that will be a tremendous opportunity to load up on these assets. Perhaps even the last such opportunity for some time.

Recommended Action: Buy silver and mining stocks on a pullback.