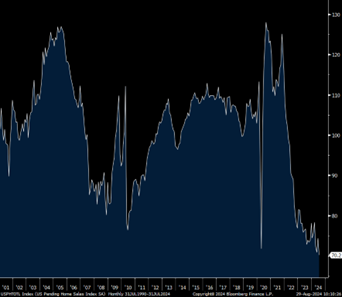

Pending home sales are awaiting a lower-rate pick-me-up. Not yet really capturing the timeframe where mortgage rates fell the most (that happened in August), July pending home sales were soft, dropping by 5.5% month-over-month versus the estimate of up 0.2%. They are down 4.6% year-over-year, observes Peter Boockvar, editor of The Boock Report.

The National Association of Realtors (NAR) said: “A sales recovery did not occur in midsummer. The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming US presidential election.”

I’ll fade the latter excuse. While one side has offered $25,000 to a prospective home buyer if elected, it has almost zero chance of being passed. Even if it did, the price of the home will likely go up by $25k and completely offset it.

(Editor’s Note: Peter Boockvar is speaking at the 2024 MoneyShow Toronto, which runs Sept. 13-14. Click HERE to register)

Pending Home Sales

The real challenge remains price and supply, as we know. I think we should wait to see the September and October housing data to really glean the impact of the recent move lower in mortgage rates. As for potential supply, a 6% mortgage rate may not bring that much more as around 80% of mortgage holders have a rate less than 5%. But we’ll take all the supply that can be provided.

Bottom line, this index goes back to 2001, and the July read was the lowest seen. As stated though, let’s wait a few months to see to what extent the move lower in mortgage rates, if sustained, triggers more activity. It hasn’t happened yet given data on weekly mortgage applications.

If all the lower mortgage rates do is bring more demand without a corresponding pick up in supply, ever-higher home prices would just offset the benefit of lower rates.