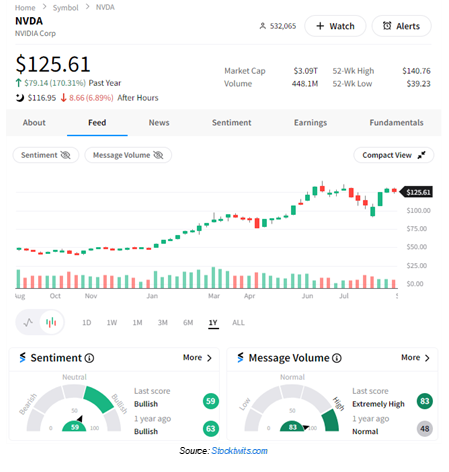

I’m going to quickly recap the biggest numbers and themes from Wednesday’s Nvidia Corp. (NVDA) report. Nvidia shares fell after it came out, though Stocktwits community sentiment remains in ‘bullish’ territory. We’ll have to wait and see how the stock reacts in the coming days, though for now, investors are a bit on edge, notes Tom Bruni, head of market research at The Daily Rip by Stocktwits.

First, the company’s adjusted earnings per share of $0.68 on revenues of $30.04 billion topped the expected $0.64 and $28.70 billion. Additionally, it’s expecting $32.50 billion in current-quarter revenue, representing 80% year-over-year growth and beating the $31.70 billion anticipated by analysts.

(Editor’s Note: Tom Bruni is speaking at the 2024 MoneyShow Toronto, which runs Sept. 13-14. Click HERE to register)

After three straight periods of 200% YOY growth, clearly comps are getting a lot more difficult, with its sequential (QOQ) growth also slowing. With Nvidia’s data center business now accounting for 88% of total revenues, the importance of its next-generation Artificial Intelligence (AI) chip, Blackwell, cannot be understated.

Nvidia's CFO said the company expects to ship several billions of dollars in Blackwell revenue, and CEO Jensen Huang added, “The change to the mask is complete. There were no functional changes necessary.”

On top of that, the company increased the size of its buyback program by $50 billion, adding to the current authorization of $7.5 billion.

Despite the strong headline numbers and continued optimism from management, investors are questioning just how sustainable the recent AI hype cycle can continue, especially since it remains unclear when the technology will contribute to companies' bottom lines.

Super Micro Computer Inc.’s (SMCI) troubles are also weighing on Nvidia, given it’s the company’s third-largest customer. SMCI dropped 20% this week after delaying its annual report just a day after Hindenburg Research published a short report questioning the company’s accounting practices.

And speaking of AI, it’s worth noting OpenAI is in talks to raise additional funds at a valuation above $100 billion. Clearly, the AI hype is still alive and well in the private markets.