I have a confession to make. There was once a time when I succumbed to the temptation of investing in story stocks. I would read, analyze, and buy and sell stocks based on my intellect, instincts, and deep experience. Now, I believe I have a far better shot at identifying a winner because of my current approach. One could be Vimeo Inc. (VMEO), notes Nicholas Vardy, editor of Microcap Moonshots.

Here’s the irony. After I abandoned that approach and embraced analytical humility, my investment performance soared. Such an "Aha!" moment is not typical of Wall Street analysts. Instead, these analysts will visit companies, construct elaborate “proprietary” models, and grill management about a company’s prospects.

They will almost invariably write a compelling recommendation. They are now deeply invested in “being right” - come heck or high water. What I do now is the opposite. I incorporate a vast array of investment perspectives other than my own. Here’s why: “To a man with a hammer, everything is a nail.”

Vimeo Inc. (VMEO)

A fundamental analyst evaluates a company through the lens of financial ratios and spreadsheet models. A technical analyst predicts a company’s future stock price by poring over chart patterns and calculating dozens of indicators. A top-down analyst focuses on the business cycle to make bets on particular sectors — industrial versus utilities, financials versus real estate, or tech stocks versus consumer staples.

I do my best to incorporate all these views - as well as many others. Here’s what I’ve found. If many of these competing approaches converge on one idea, I have a far better shot at identifying a winner. That’s the investment philosophy behind Microcap Moonshots.

As for VMEO, it operates a video experience platform, providing a full breadth of video tools through a software-as-a-service (SaaS) model. The Company's comprehensive and cloud-based tools encourage its users to create, collaborate, and communicate with video on a single, turnkey platform.

The bullish investment case is based on...

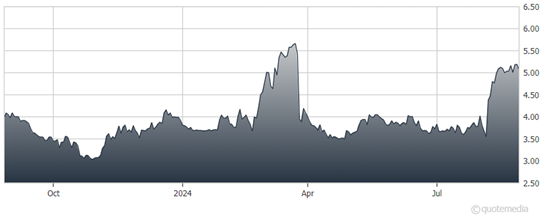

- Strong Momentum and Recovery Potential: Vimeo has demonstrated strong recent momentum, with significant increases in share price over the past few months (up 32.7% in the last month and 28.4% in the previous three months). This performance suggests the company is gaining traction and recovering from earlier challenges.

- Improving Profitability and Financial Health: Vimeo has made substantial strides in improving its profitability, with a positive operating margin of 5.06% and a return on equity (ROE) of 8.63%. The Company's strong balance sheet, highlighted by a net gearing of -78.06% and a high cash-to-assets ratio of 49.59%, indicates financial stability and capacity for future growth.

- High-Quality SaaS Platform with Growth Potential: Vimeo operates a comprehensive video experience platform with a SaaS model, catering to a broad market with cloud-based video creation and collaboration tools. The Company's strong fundamentals make it a compelling long-term play in the technology sector, especially as digital content and video expand in importance across industries.

Recommended Action: Buy VMEO.