Gladstone Investment Corp. (GAIN) reported a slight decline in gross investment income for the quarter just ended. But lower expenses after high gains-based incentive fees the previous quarter meant that net investment income increased at the Business Development Company (BDC), highlights Adrian Day, editor of Global Analyst.

During the quarter, Gladstone put two new companies on non-accrual status, bringing the total to four, representing nearly 8% of the fair value on debt investments. The company emphasized, however, that these two companies are now profitable and should return to accrual status over the next year.

(Editor’s Note: Adrian Day is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register.)

This move reflects softness in the small business sector. Gladstone also said it saw an increase in opportunities for new investments, though the competitive environment was pushing up valuations.

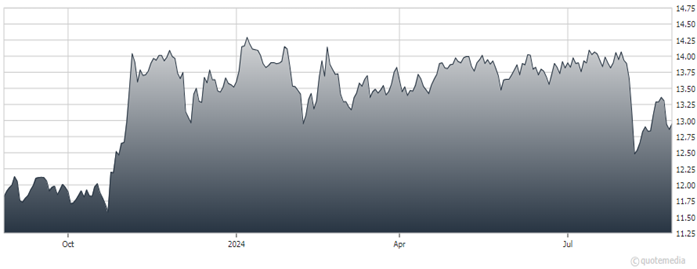

Gladstone Investment Corp. (GAIN)

Gladstone has low leverage, and the dividend is covered by net investment income. Trading just below book, the stock had a recent yield of 7.5% based on its regular monthly dividends. Gladstone also pays a monthly dividend based off its debt income, and irregular supplemental dividends from net capital gains.

Last year, these supplemental dividends were particularly strong at $1.48 per share, though this year so far, it has not paid any. Gladstone can be bought here for the yield. But we are not expecting dramatic capital appreciation, given the aggressive use of its ATM for equity sales when the stock moves to a premium over book value.

Recommended Action: Buy GAIN.