In an Instagram story last summer, a US defense giant known for missiles and jets stunned everyone by dropping a bomb. The company: Lockheed Martin Corp. (LMT), builder of the sub-warfare-revolutionizing Polaris missile, and breakthrough combat planes like the P-38 Lightning, the SR-71 Blackbird, and the F-117A Nighthawk Stealth Fighter, writes Bill Patalon, chief stock picker at Stock Picker’s Corner.

The occasion was the 80th anniversary of LMT’s famed Skunk Works unit — kind of a defense-industry “Mad Scientist’s Lab” that’s minted some of America’s best combat planes over its eight-decade stretch. And the bombshell was a “slide show” that not only spotlighted some of the great aircraft the Skunk Works has delivered, but also included a final image of a futuristic jet that doesn’t officially exist.

Did the company “sneak in” a sketch of the futuristic jet it’s working on for the US Air Force’s super-secret/next-generation fighter program? That image whipped up one heck of a buzz. And it’s for a good reason.

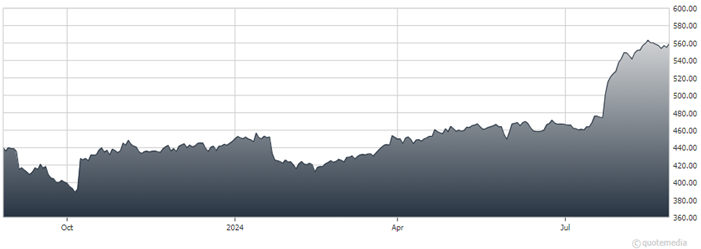

Lockheed Martin Corp. (LMT)

There’s been a ton of interest in this initiative — known in Pentagon-speak as the “Next-Generation Air Dominance” (NGAD) program. The Air Force is right now analyzing the cost and feature levels of these stealthy, “sixth-generation” jets, which could run $200 million to $250 million each. It could push ahead with NGAD, or use what it learned to develop a leaner, cheaper (but still advanced) jet. Stay tuned!

In the meantime, for its second quarter, Lockheed said net sales surged 9% to $18.1 billion. Net earnings came in at $1.6 billion, or $6.85 a share, up from profits of $1.7 billion, or $6.63 a share, last year.

It also boosted its full-year guidance on revenue (to a range of $70.5 billion to $71.5 billion from its April forecast of $68.5 billion to $70 billion) and earnings per share (to a range of $26.10 to $26.60 from the April projection of $25.65 to $26.35).

Lockheed achieved what I’ve nicknamed the “earnings report trifecta”: It beat on revenue and profits – and boosted its guidance. Its backlog is about $160 billion right now – or more than two years’ worth of revenue (net sales were $67.6 billion in 2023).

Between dividends and buybacks, the company funneled $1.6 billion back to shareholders in that second quarter. Lockheed returned $9.1 billion to shareholders for all of 2023.

The dividend yield was recently 2.2%. But the $12.60 a share in actual cash could add up quickly — for use buying other stocks. It’s a New Cold War stock that we’ll keep watching...and I’m looking at others as well.

Recommended Action: Buy LMT.