Housing is in a summer slump, but help is on the way. Meanwhile, DR Horton Inc. (DHI) is one of the largest US homebuilders based on home deliveries and revenue. We remain bullish on homebuilders because we believe there is currently a major shortage of affordable homes, asserts John Eade, president of Argus Research.

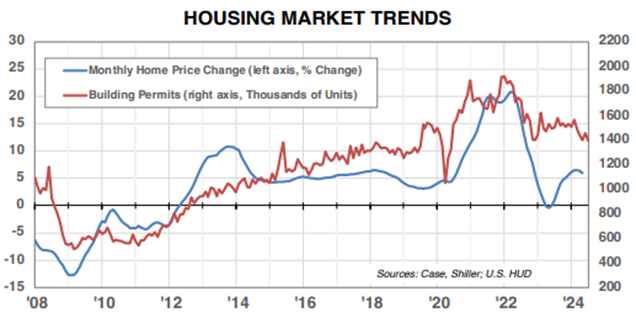

A 50-basis point decline in the 30-year mortgage rate since June and a likely rate cut from the Fed may not solve all of the market’s affordability issues – but they sure will help. Housing starts fell to an annual rate of 1.24 million in July, which is the lowest pace in more than four years, according to data from the Department of Housing and Urban Development and the Census Bureau.

Starts peaked at 1.8 million in April 2022, just a month after the Fed’s first of 11 interest rate hikes in March 2022. Tighter monetary policy ended a long recovery from the Great Recession of 2007-2009. But signs that the Fed is poised to ease policy and reduce the funds target could bring buyers back into the market.

From a housing perspective, relief can’t come soon enough. Based on the August 16 GDPNow estimate from the Atlanta Fed, residential fixed investment is expected to decline by an annualized 11.7% in 3Q after a 1.4% drop in 2Q. While the S&P/Case-Shiller National Home Price Index jumped 5.9% in May, we expect growth to soften to 5% for June.

We remain bullish on the sector because demographics point to strong demand amid a decades-long shortage of affordable homes. In our view, DHI’s size, financial strength, and geographic diversity provide an edge in delivering affordable homes. Approximately 69% of the homes DHI delivered in the 12 months ended on June 30 sold for less than $400,000.

Recommended Action: Buy DHI.