We just named Alibaba Group Holding Ltd. (BABA), the China-based online shopping juggernaut, a “Buy.” The company generates most of its revenue from multiple e-commerce businesses, but it also has a booming cloud business, which saw AI-related product revenue post triple-digit growth year-over-year during the most recent quarter, says Clif Droke, editor of Cabot Turnaround Letter.

Although Alibaba is an e-commerce leader in China, it’s relatively unknown to casual shoppers in the United States and Europe. And on that front, the company is actively trying to expand its footprint internationally, especially through its retail platform AliExpress, which sells directly to consumers worldwide. Meanwhile, Alibaba Cloud, its cloud computing arm, has been growing its data centers and services outside of China, particularly in Asia, Europe, the Middle East, and North America.

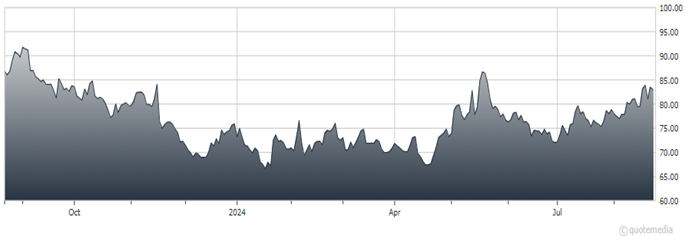

Alibaba Group Holding Ltd. (BABA)

Alibaba’s financial arm, Ant Group, has also been increasing its digital payment services internationally through partnerships and acquisitions, while its digital wallet, Alipay, is being introduced in several new foreign markets. I see the push toward international expansion as a big part of the turnaround story here.

In terms of the key financial metrics, Alibaba’s free cash flow dropped in fiscal Q1. The company attributed this to a “significant increase in expenditure on the AI infrastructure investments.” But it expressed confidence that it would return to double-digit growth in the second half of the fiscal year, with gradual acceleration thereafter, as it begins to execute on its integrated cloud and AI development strategy.

More recently, a major Wall Street bank just released a list of the 50 stocks that most frequently appear among the top 10 holdings of “fundamentally-driven investors from quantitative funds or funds that mirror private equity investments,” which is another bullish factor going forward.

Admittedly, however, a position in Alibaba is not without above-average risk due to the weak economic backdrop for China. For that reason, I’ll be keeping this stock on a tighter leash than I normally allow our other portfolio holdings.

Recommended Action: Buy BABA.