Crude oil has mostly traded sideways year to date. It’s a similar story for energy equities. For example, energy producer Chevron Corp. (CVX) was recently down 3% YTD while the S&P 500 was up about 18%. Is the energy trade over? What does the future hold for these stocks? Let’s look at recent trends and upcoming seasonality for clues, notes Steve Reitmeister, editor of Zen Investor.

At the start of 2024, oil prices hovered around $70 per barrel. By mid-March, prices climbed past $80 and largely remained there until dipping below that level in May.

Since then, oil has traded within a narrow range near $80 per barrel, even with heightened tensions in the Middle East after the unexpected Hamas attack on Israel in October 2023 and Israel’s subsequent military response in Gaza. While there are still fears of a broader conflict, they haven't materialized yet.

Meanwhile, US oil production continues to be robust, with the country now a net exporter, reducing its vulnerability to oil supply shocks. We’ve also seen some weaker consumer data which has resurfaced some recession fears among investors.

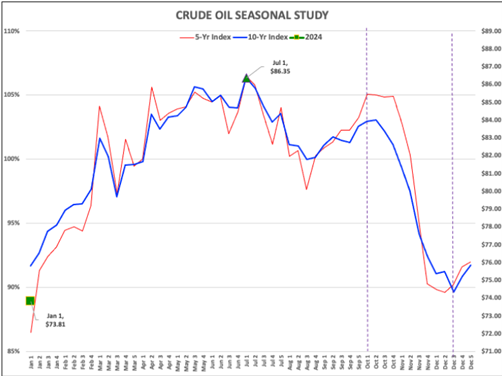

Whether you’re a trader or a long-term investor, it’s important to understand seasonality in the energy markets. For example, we can see below that over the past five to ten years, oil tended to reach its highest levels for the years in early April and early July, typically topping around July 1.

Source: Nasdaq.com

These patterns aren’t perfect…but they’re a helpful guide. You’ll see that after the July peak, oil tends to slump until the end of August, then rally into September and October. After October and into the end of the year, oil enters its weakest period of seasonality, before bottoming around January 1.

What does all this mean now? For traders, this could be a time to enter or add to oil stocks, and then take profits during September and October. Alternatively, a trader or investor looking to add exposure could wait for the historical seasonal bottom which comes on the first day of the new year.

What does all this mean now? For traders, this could be a time to enter or add to oil stocks, and then take profits during September and October. Alternatively, a trader or investor looking to add exposure could wait for the historical seasonal bottom which comes on the first day of the new year.

What about the longer term? Consensus is still that oil demand will grow well into the end of the decade, which bodes well for energy stocks. According to the IEA, total oil demand is still forecast to rise by 3.2 million barrels per day between 2023 and 2030.

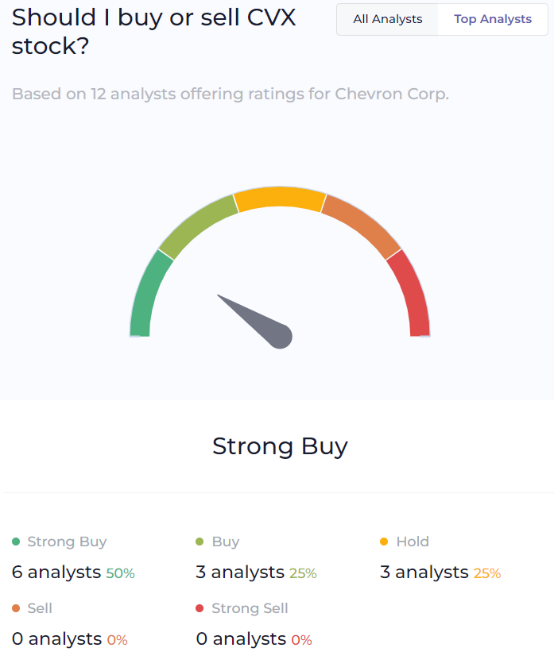

Additionally, the world’s best investor, Warren Buffett, still holds over 10% of his firm’s equity portfolio in two energy stocks: Occidental Petroleum Corp. (OXY) and Chevron. Chevron is the better-screening of the two, plus a consensus buy according to top analysts.

So, while seasonality always brings some volatility to the oil market, it may still be a great trade for years to come for patient investors.

Recommended Action: Buy CVX.