Long options straddles thrive during times of high volatility in an underlying stock. However, during these big moves in the underlying stock, managing the straddle is crucial to lock in profits, writes Aravind Siva, certified options trader.

In a long straddle, when the underlying stock goes above the breakeven point, the calls will profit and the puts will be completely out of the money, resulting in an overall profitable position. However, it is necessary to hedge this position in case of a huge downside movement in the stock.

One effective strategy, in this scenario, is to short the stock. Since short stock and long calls make synthetic long puts, one should short enough stock to convert all of the calls into puts. This changes the position to all long puts, which hedges against the potential downside move in the stock.

This is also while the profit on the calls are secured, since the stock’s price went above the upside breakeven point (UBEP). The same strategy can be applied when the stock goes below the downside breakeven point (DBEP) by simply buying enough stock so that all of the puts are converted into synthetic long calls. This creates a position of all long calls, while the profits on the puts are captured, hedging against a potential upside move in the stock.

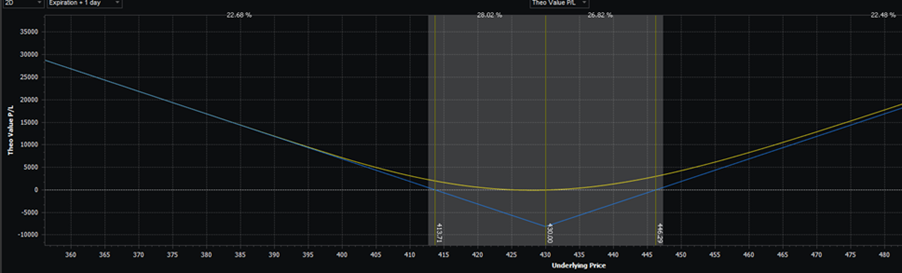

Let’s look at a recent real example, with 10 of the March 15 QQQ at the money (ATM) straddles. QQQ was trading at $429.62 at the time, so an ATM straddle would have been at a strike price of $430. The straddle would have cost $16.29, so the UBEP would have been $446.29 and the DBEP would have been $413.71. Since this would have been a long position, the $16.29 premium was your maximum loss for each straddle.

Suppose that QQQ traded up to $455. Then, the calls would have been deep in the money (ITM) by $25. The puts would have been nearly out of the money (OTM) and worthless, since the UBEP was passed. Each straddle would have been at a profit of $8.71, which you got by subtracting the UBEP from $455.

Using the strategy, you would have shorted 1,000 shares of stock to convert the 10 long calls into 10 synthetic long puts. This would have left you with an overall position of 20 long puts, and that would have helped hedge against any potential downside movements in QQQ while also securing that $8.71 profit on each of the original long calls.

While hedging, it is important to keep in mind changes in delta, as delta changes rapidly as expiration gets closer due to call deltas approaching either 0 or 100 deltas. Thus, being prepared to hedge more often near expiration is always beneficial while managing long straddles.

Additionally, being ready to constantly hedge against your ever-changing deltas is an efficient strategy, which can entail buying/selling both stocks and options as needed.