A margin of safety policy pays off. Most of our investments handled early August’s market meltdown better than the major stock market indexes. In market drops, they’ll hold up better than the major indexes while earning solid returns during high-spirited markets. Meanwhile, I recommend the Invesco India ETF (PIN), advises Bob Carlson, editor of Retirement Watch.

Taking advantage of the market volatility to move some money from principal-protected investments to a couple of international stock funds makes sense. India is one of the world’s fastest-growing economies and top-performing stock markets. It is less correlated with many global equity markets. It held up well in the recent decline and was a strong performer before then.

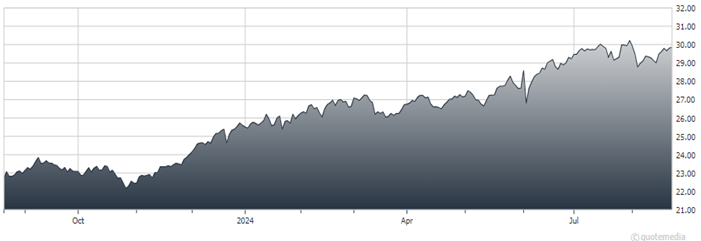

Invesco India ETF (PIN)

India is taking some of the business that businesses are moving from China. A risk is it seems there’s often political uncertainty in India, and that can lead to fluctuations in the economy and stock market. But PIN tracks the FTSE India Quality and Yield Select Index, has very low expenses, and has generated solid long-term performance.

The fund recently held about 190 securities with 36% of the fund in the 10 largest positions. PIN was down 1.4% in a recent four-week period. It gained 9.6% over three months, 14.5% for the year to date, and 28.4% over 12 months.

Recommended Action: Buy PIN.