We are fully invested in the stock market, but I often wonder how long it will last, given the growing threat of recession and a new president. For now, our portfolio is doing quite well, with all of our stocks and funds making money this year. Goldman Sachs Group Inc. (GS) is a standout, writes Mark Skousen, editor of Forecasts & Strategies.

I see that “Dr Doom,” NYU Professor Nouriel Roubini, plans to launch an ETF based on his calamitous outlook. His timing may be good, especially if the Democrats take control of Washington.

Interestingly, Dr. Doom’s ideal portfolio will consist of short-term Treasuries (up to two years), and non-correlated investments in gold, “climate-resilient” Real Estate Investment Trusts (REITs), Treasury inflation-protected securities, and agricultural commodities – deemed as strategically important “when food supply is threatened by climate and geopolitical conflict.”

(Editor’s Note: Mark Skousen is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

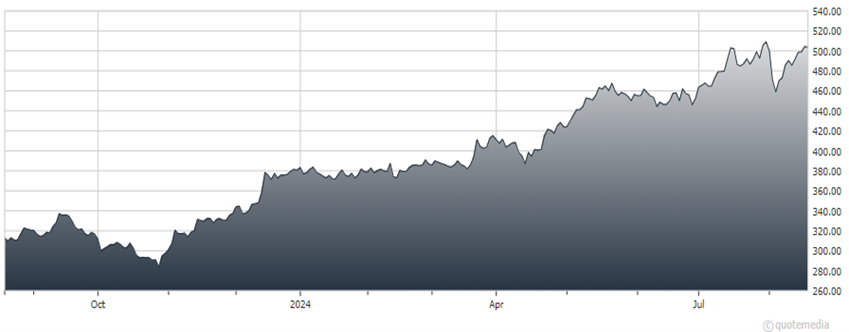

Goldman Sachs Group Inc. (GS)

He claims his ETF will do “well in good times and bad,” but I doubt it will beat our investment portfolio. Instead of calling his fund "The Atlas Capital Fund," maybe he should call it "The Atlas Shrugged Fund"!

Meanwhile, GS is up 31% year to date, and ahead 57% in a little over a year. It just raised its dividend to $3 a share, to be paid on Aug. 30. It maintains its long-standing #1 rank in announced and completed M&A transactions and ranked #2 in equity underwriting.

Goldman has high ambitions. Its Asset Management unit hopes to expand its private credit portfolio to $300 billion in five years from the current $130 billion.

Recommended Action: Buy GS