The haters are out in full force. Wall Street “pros” are downright disgusted with high-yield stocks. Here at Contrarian Outlook, this pessimism warms our heart. With no analysts left to slap a “Sell” rating on top names, the future is filled with upgrades. I like Washington Trust Bancorp Inc. (WASH) and its recent 7.8% yield, counsels Brett Owens, editor of Contrarian Income Report.

Consensus “Buy” calls are a dime a dozen. Analysts notoriously lean, ahem, optimistic, so there’s nothing special about a stock that’s dripping in positive ratings.

But if a stock is stuffed with Sells, that’s rare, and I take notice. How unusual are Sell calls? Just one S&P 500 stock is rated a consensus Sell right now.

As for WASH, it is a regional bank that is neither in Washington State nor Washington, DC. Instead, this 224-year-old financial institution was named for the nation’s first president, and it was “the first bank to print George Washington’s likeness on currency – 69 years before President Washington appeared on the federally issued one-dollar bill and 132 years before the Washington quarter appeared.”

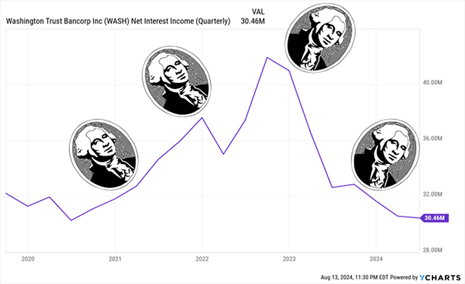

WASH has a 50/50 split of “Holds” and Sells, largely because the bank’s Secured Overnight Lending Rate (SOFR)-linked loans are acting as a drag on margins. That has forced Washington Trust into a defensive position; it’s largely focused on preserving capital and keeping a cap on expenses.

So, it could be a rough few quarters for WASH. Dividend coverage could float above 90% this year. But the bank’s troubles at least appear temporary in nature, and that dividend coverage should loosen up once the Fed lowers rates, which should eventually widen WASH’s margins.

Recommended Action: Buy WASH.