With two-thirds of US GDP attributed to consumer spending, it makes sense that the market cares so much about households' financial health. Luckily for investors, July retail sales jumped 1% compared to the 0.3% estimate. We also heard good news from Walmart Inc. (WMT), highlights Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Retail sales were led by strength in automobiles, electronics/appliances, and food and beverage outlets. Additionally, initial jobless claims hit a five-week low and helped ease some concerns that the labor market could be headed for a major uptick in unemployment.

(Editor’s Note: Tom Bruni is speaking at the 2024 MoneyShow/TradersEXPO Orlando, which runs Oct. 17-19. Click HERE to register)

As for WMT, it is the largest US retailer and a barometer for consumption trends. A stronger-than-expected first half caused management to raise its full-year revenue and earnings outlook. Still, it cautioned that the second half of the year would likely be slower.

CFO John David Rainey said, “We see, among our members and customers, that they remain choiceful, discerning, value-seeking, focusing on things like essentials rather than discretionary items, but importantly, we don’t see any additional fraying of consumer health.”

However, pockets of strength are worth noting, such as positive sales growth in general merchandise for the first time in eleven quarters. The company’s focus on groceries remains another strong point, as customers look for cheaper alternatives to fast food.

Lastly, Walmart’s e-commerce push continues to pay off, with sales jumping 22% year-over-year in the US and 21% globally. Total in-store and online transactions rose 3.6% YoY, and the average ticket rose 0.6% YoY.

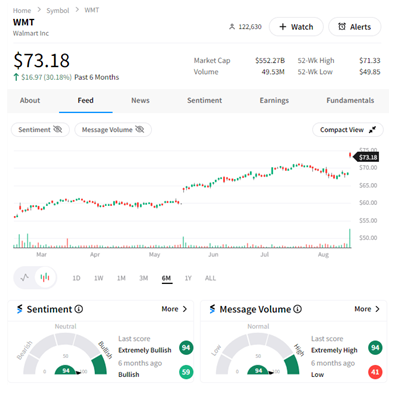

Walmart shares gapped up 7% and maintained those levels, closing at a new all-time high amid "extremely bullish" sentiment readings on Stocktwits.

Overall, the positive data was great for Walmart and the broader market. It helped give bulls the confidence to continue their recent buying spree and to set their sights on new all-time highs.