When you examine the top-performing stocks of the past century, one thing becomes clear: Long-term, steady returns can lead to astronomical gains. Seemingly boring companies like Altria Group Inc. (MO) have turned modest investments into massive fortunes by compounding returns over decades, explains Nicholas Vardy, editor of The Global Guru.

The significance of this cannot be overstated, as it highlights the potential for extraordinary gains in the stock market. Altria, formerly Philip Morris, tops the list with a staggering 265,528,900% cumulative return since 1925, emphasizing the power of reinvested dividends and long-term holding.

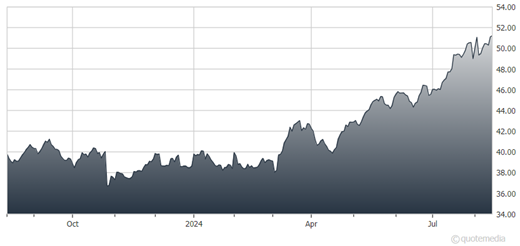

Altria Group Inc. (MO)

That performance smashes two unlikely candidates: Alabama gravel giant Vulcan Materials Co. (VMC) and Kansas City Southern, a railway operator subsumed by Canadian Pacific last year and now known as Canadian Pacific Kansas City Ltd. (CP). A dollar invested in those would “only” be worth $393,492 and $361,757 today.

The top performers are all old, established companies in less glamorous industries, underlining the importance of longevity and consistent returns over time.

Also consider this: The median lifespan of US stocks is just 6.8 years. Over half of all the nearly 30,000 common stocks registered by CRSP have incinerated money. Only a tiny fraction, like the 31 companies present throughout the 98 years of the CRSP dataset, achieved substantial long-term success. This stark contrast underscores the rarity and value of long-term success in the stock market.

When looking at annualized returns over the past 20 years, Nvidia Corp. (NVDA) leads with a 33.38% return. That highlights the substantial growth of newer tech companies.

Meanwhile, the list includes surprising entries like scientific publisher Plenum and pool distributor Pool Corp. (POOL). These examples demonstrate that even unconventional businesses can achieve significant stock market success.

Understanding the power of long-term investments in the stock market is not just beneficial. It's crucial. It reveals that steady growth, even in less-exciting sectors, can yield extra returns over time.