Are the “Mega Cap” stocks dead? Maybe. But there are four reasons why they could be staged for a comeback. The recent market correction from the July peak certainly got investors’ attention and rattled the more extreme complacency, notes Lance Roberts, editor of Bull Bear Report.

As I repeatedly discussed in June and July, a 5%-10% correction is normal and occurs almost yearly. Unsurprisingly, retail and professional investors have witnessed a more extreme amount of selling of large-cap positioning over the last three weeks. The question is whether the correction process is over and whether investors will return to the mega-caps in their portfolios

There are four reasons why investors, both professional and retail, were chasing a handful of stocks. They are also the same reasons that mega-caps will likely regain their favor.

First, these stocks are highly liquid. Managers can quickly move money into and out of them without significant price movements. The importance of liquidity cannot be overlooked for insurance companies, pensions, hedge funds, and endowments.

Second, the passive indexing effect has not gone away. As investors change their investing habits from buying individual stocks to the ease of purchasing a broad index, capital inflows unequally shift into the largest capitalization stocks in the index. Over the last decade, capital inflows into ETFs have exploded.

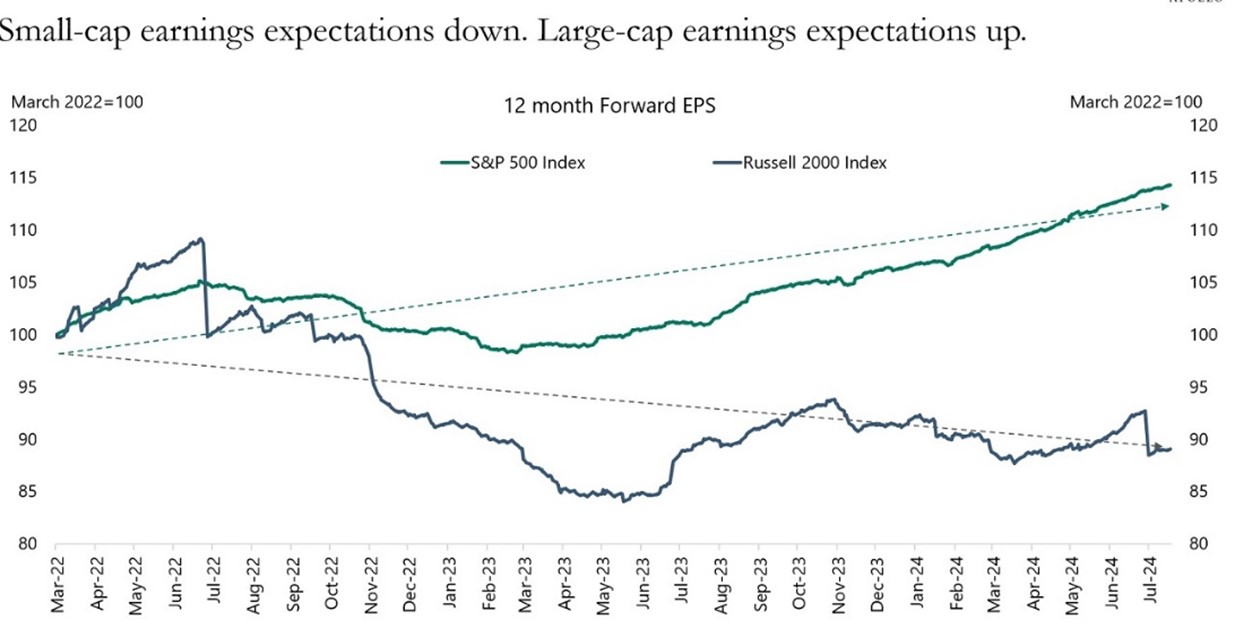

Third, the mega-cap companies have more substantial earnings growth than their small – and mid-cap – brethren. For now, the large-caps are driving most of the earnings growth. With the economy showing clear signs of deterioration, earnings of small and mid-cap companies remain the most vulnerable to changes in economic demand.

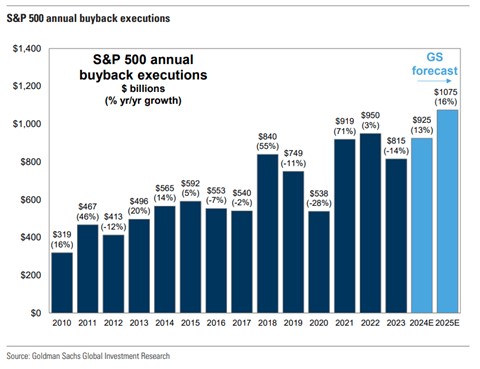

Fourth, and probably most importantly, large-cap companies engage in share repurchases much more than small and mid-caps. Corporate share buybacks will approach $1 trillion this year and exceed that in 2025, with Apple Inc. (AAPL) alone accounting for more than 10% of those purchases.

So, are mega-caps likely becoming a “mega-buy?” That may be stretching it a bit. But what is likely is that the recent underperformance is near its conclusion.