Let’s talk about moats. Not the kind you find around castles, but the kind that protect companies from their competitors. When we say a company has a “moat,” we’re talking about its ability to fend off rivals and keep profits rolling in. That’s what the VanEck Morningstar Wide Moat ETF (MOAT) invests in, explains Steve Reitmeister, editor of Zen Investor.

Why do moats matter? Think of them as safety nets for your investments. Companies with wide moats are often better equipped to handle whatever the market throws at them…and insulate themselves from competition.

This idea comes straight from Warren Buffett’s playbook. He’s always looking for businesses with something special, like a strong brand or unique tech, that keeps competition at bay. For us investors, finding these moat-worthy companies is key to building a portfolio that stands the test of time.

Sometimes, you’ll be lucky enough to notice moats on your own. Maybe you noticed everyone was addicted to their iPhone. Or that everyone swipes a card issued by Visa Inc. (V) or Mastercard Inc. (MA) to pay for things.

But these flashes of insights only come so often, if at all. And hunting down individual moat stocks can be time-consuming. That’s why we keep an eye on MOAT. This ETF bundles together a bunch of companies that Morningstar Inc. (MORN) has identified as having solid, competitive moats.

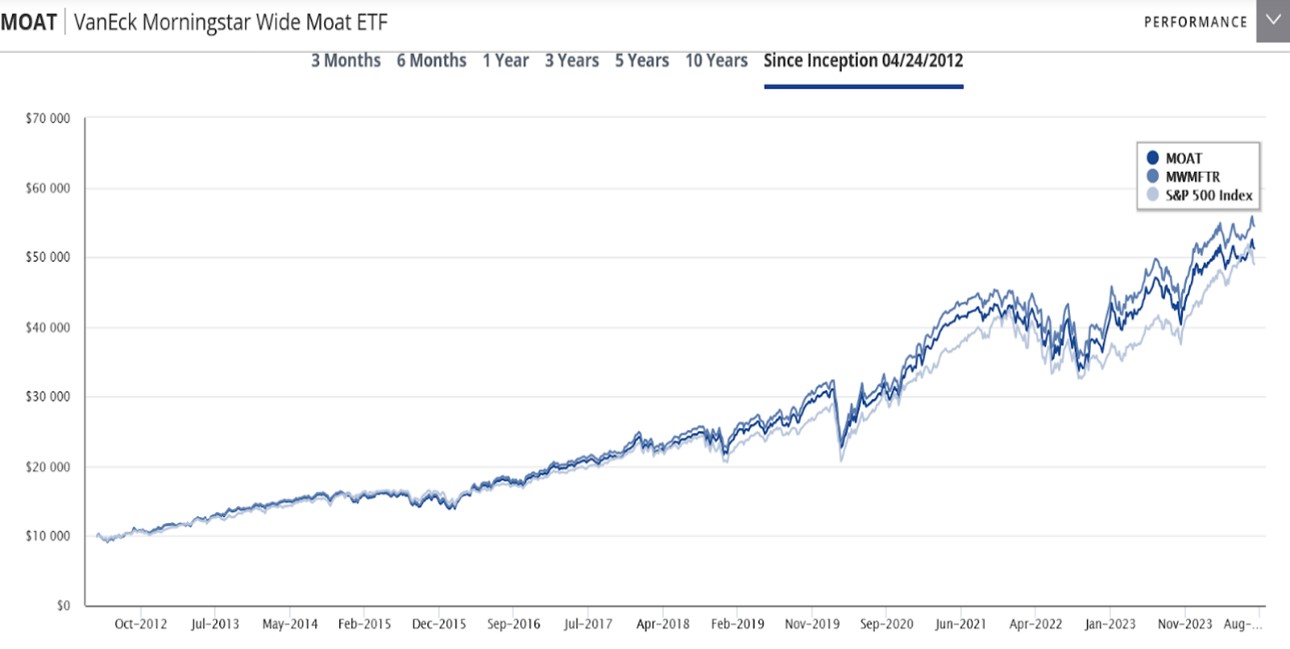

As an added bonus, it’s equal-weighted, so you’re not just betting on one or two big names. Plus, the ETF also focuses on companies that are fairly valued, giving you a good mix of quality and value. MOAT has slightly outperformed the S&P 500 since inception.

One name we’re watching in MOAT is Comcast Corp. (CMCSA), clocking in at 2.4% of the fund. Comcast’s moat comes from its cable business. The majority of US homes today can receive fixed-line internet access service from only two providers: The traditional cable or phone company. Across nearly half of the US, that cable company is Comcast. The cost to enter the market and compete with Comcast is enormous.

It’s a similar story with Zimmer Biomet Holdings Inc. (ZBH), which is 2.29% of the fund. This company makes orthopedic devices for joints and bones.

Here, the moat comes from substantial switching costs for orthopedic surgeons. The extensive instrumentation, or tool sets, used to prepare bones and install implants are specific to each company. So, the learning curve to become proficient in using one company's instrumentation is huge.

Recommended Action: Buy MOAT.