Did you notice that both the S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust (QQQ) were positive for last week? The US Financials Index was also positive. So were the industrials, and so was energy. Technology was up for the week, too. So was communications. It's a bull market, writes JC Parets, founder of AllStarCharts.

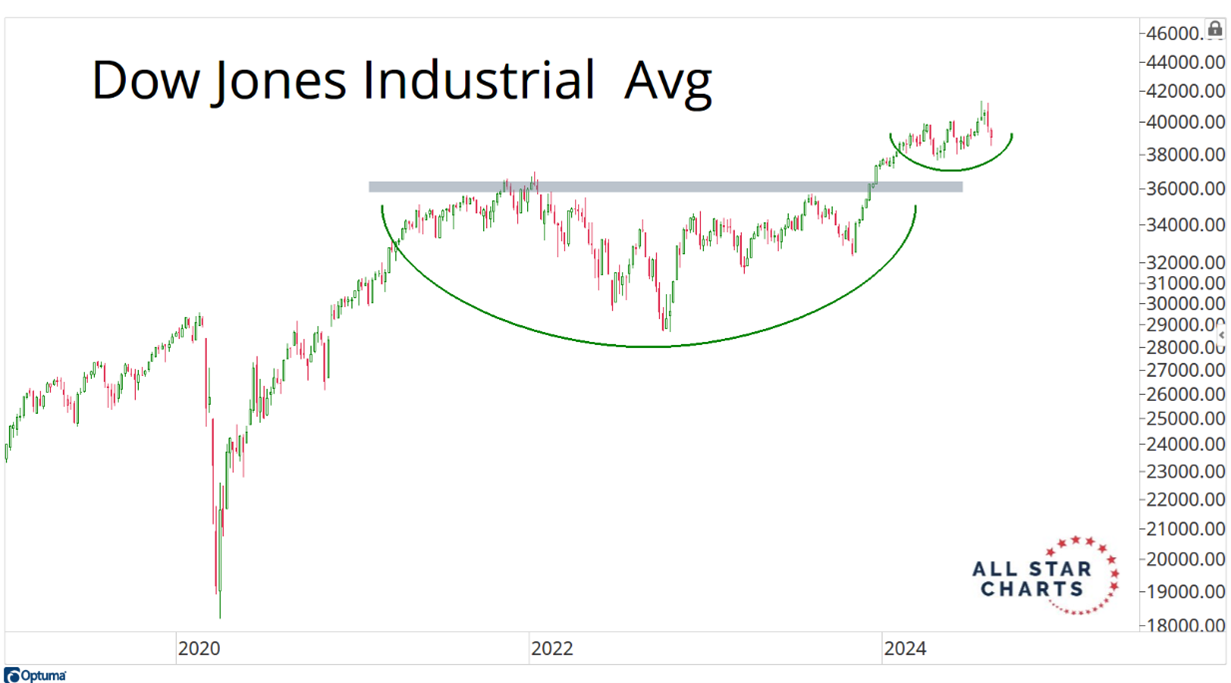

Is it weird that so many stocks were up for the week in the middle of a bull market? Look at the Dow Jones Industrial Average. Does this look like a downtrend to you?

This is the world's most important stock market index continuing to act well.

It's really helpful to look under the hood at the components of an index if you're trying to get a better idea of the next direction for that index. In the case of the 30 stocks in the Dow Jones Industrial Average, I counted 12 of them that are currently in uptrends. Fifteen of them are in sideways trends and only three are in downtrends.

That leads me to believe that there is a lack of leadership to the downside. And with 15 stocks in sideways trends, there is plenty of room for some of those stocks to enter into uptrends, driving the Dow 30 Index substantially higher.

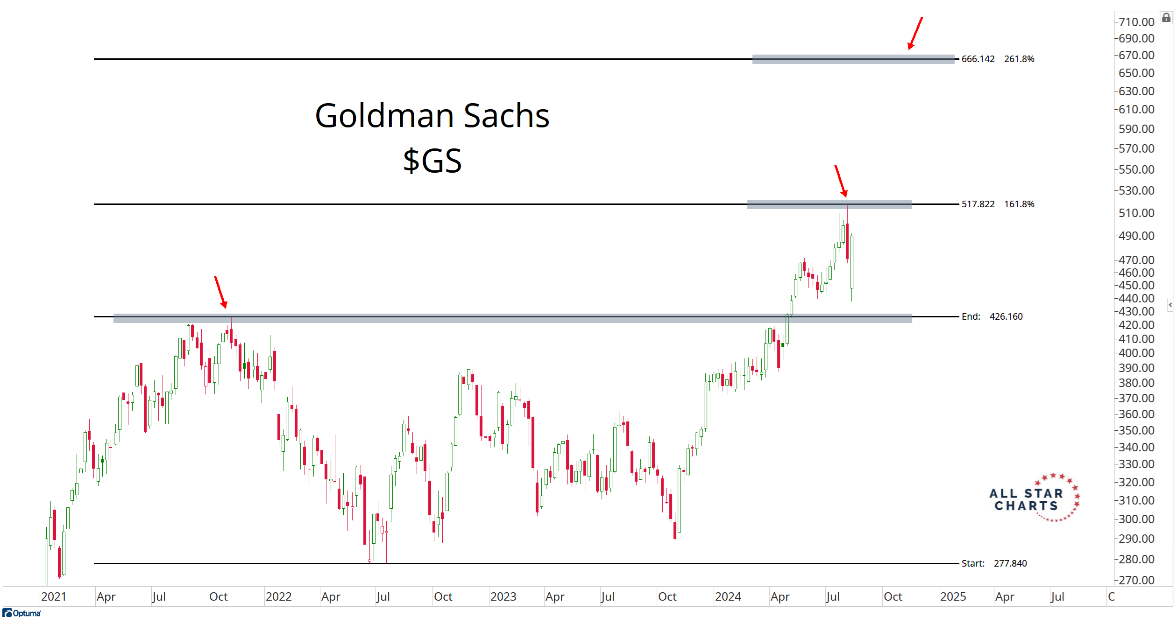

One such name is Goldman Sachs Group Inc. (GS), which made new all-time highs just seven trading days ago:

What's funny is that the next extension target for Goldman Sachs is 666. Is that appropriate, considering its nickname “The Evil Empire?” It's just math. You can't make it up.