We’ve been expecting the stock market to churn for a while. We didn't expect it would churn so much in just one week as it did last week. So, now what? Our bet is probably more churning ahead with lots of volatility through the presidential election – and then, a year-end rally, advises Ed Yardeni, editor of Yardeni QuickTakes.

This week is jam-packed with economic indicators that are likely to show that retail sales and industrial production weakened during July, as expected since employment was weak during the month. The week's inflation indicators might show that it edged higher during July, as widely expected.

(Editor’s Note: Ed Yardeni is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

As a result, Fed officials might push back against market expectations that September's federal funds rate cut might be more than 25 basis points, especially if they agree with us that bad weather depressed the economy and employment last month. That view should be confirmed by another downtick in Thursday's jobless insurance claims report.

Another wild card is the worsening geopolitical situation. Ukraine's president just confirmed that his troops are fighting inside Russia. The war could get uglier depending on Russia's response. Israelis are bracing for a missile attack from Iran and its proxies in the Middle East. Meanwhile, Hamas reportedly wants a ceasefire deal. The Philippine military said on Saturday it strongly condemns “dangerous and provocative actions” by China's air force at a contested shoal in the South China Sea.

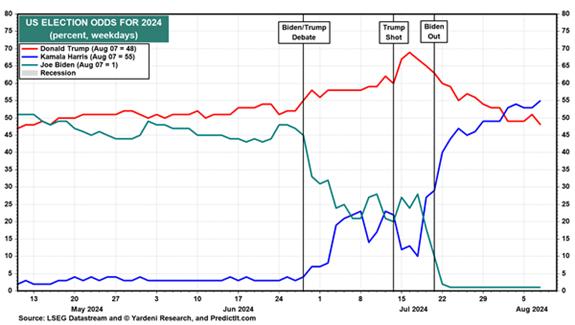

Of course, another source of volatility is the US presidential election. PredictIt.com suggests that the outcome is hard to predict. Even harder to predict is the outcome of the congressional races.

We think that many of these uncertainties might be resolved between now and the November elections -- in a bullish fashion and just in time for a year-end rally. In this optimistic scenario:

(1) The hard-landers would be wrong again.

(2) Inflation would continue to moderate.

(3) The Fed would be “one-and-done” for the year, with the 10-year Treasury trading between 4% and 4.5%. In his Jackson Hole speech on Aug. 24, Fed Chair Jerome Powell is likely to signal a 25 bps FFR cut in September, but to be noncommittal about future actions.

(4) The geopolitical situation will probably remain unsettled and unsettling, but it shouldn't adversely impact the global economy.

In this scenario, the S&P 500 might continue to churn below its July 16 record high through the November elections before resuming its climb to new highs over the rest of the year and into 2025. The market might also broaden with the Magnificent Seven stalling, while the S&P 493 outperform.

Subscribe to Yardeni QuickTakes here...