Markets remain on edge. Last Monday, trading in 401(k)s was more than eight times the daily average, the highest since 2020. My guess is that most of this activity was selling rather than buying. Meanwhile, I’m moving Super Micro Computer Inc. (SMCI) to a “Buy,” writes Carl Delfeld, editor of Cabot Explorer.

Before getting to why we need to stay calm and keep this market volatility in perspective, let me briefly cover what prompted Japan’s stock selloff and why it spread. Japan’s weak yen had been inflating corporate profits and valuations, and therefore fueling the most robust stock rally in decades. Foreign investors provided much of the capital flows, as interest in China waned.

That dynamic turned on a dime two Wednesdays ago, when the Bank of Japan unexpectedly raised its key interest rate for only the second time in nearly two decades. The rate hike sent the yen up past 150 to the dollar and investors started selling Japanese stocks as well as US stocks. Japan’s stock market then rose last Tuesday after the Bank of Japan promised not to raise interest rates while markets are unstable.

Super Micro Computer Inc. (SMCI)

Japan aside, before last week’s pullback, the S&P 500 technology sector was up more than 80% from its bear market low in October 2022. That's why I have been beating the drum that a pullback in big tech was inevitable. Stock prices fluctuate, and sometimes faster and more unexpectedly than is rational.

This highlights the need to have a flexible strategy that reduces the chance that you are selling or buying at the worst time. In general, having a sizable cash position, a well-diversified core portfolio, and a separate, trading-oriented “explore” portfolio will help you keep the core in place. You should also always have a list of five to six stocks that you want to buy if markets sell off quickly

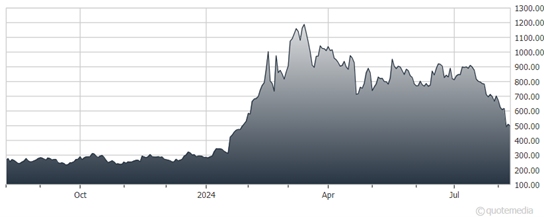

As for SMCI, its shares closed 30% lower last week even after it reported quarterly revenue surged 143% and it estimated the next quarter’s revenue will be up more than 200%. Concerns include Nvidia Corp. (NVDA) announcing a delay in some new products as well as lower gross profit margins.

The stock is still up 75% since the start of the year, but it’s down nearly 60% from its March record high. Super Micro has been buoyed by accelerating spending on AI data centers. We have taken some profits, but I’m moving this to a “Buy” now.

Recommended Action: Buy SMCI.