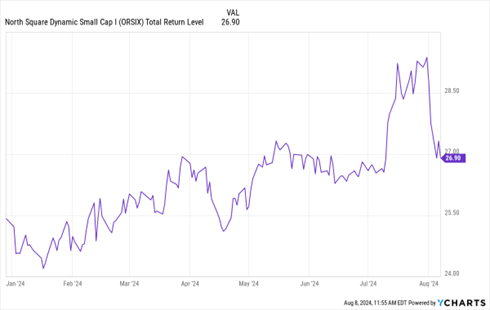

On Wednesday, US stocks couldn’t hold gains from earlier in the session. Big tech stocks like Nvidia Corp. (NVDA) and Tesla Inc. (TSLA) declined about 3.5%. But overall, the markets seem to have calmed down from Monday’s sharp downturn. I like the North Square Dynamic Small Cap I Fund (ORSIX), writes Brian Kelly, editor of Money Letter.

The volatility we have witnessed since the end of July is upsetting, but not unexpected. With equities trading near all-time highs, any hint of a growth scare was bound to take its toll on stock prices. But with accommodative monetary policy due in the very near future, we expect the economy to avoid recession. Stocks should regain any summer losses once the Federal Reserve eases policy interest rates.

North Square Dynamic Small Cap I (ORSIX)

Data by YCharts

Our global markets hit a recent peak last Wednesday and are all down substantially over the weekly Hotline reporting period (August 1 – August 7). The S&P 500 declined 5.8%; the Euro Stoxx 50 fell by 4.2%; the Nikkei 225 plunged 10.3%; and the Shanghai Composite moved 2.3% lower.

As we have been saying for some time now, the biggest risk to the markets is substantial economic slowing. Growth worries will continue to fuel volatility in the near term, and some of it will be nerve wracking.

However, we continue to think favorable Fed policy will help guide the economy through this rough patch, most likely short of recession. Even if we do enter a technical recession, we expect it will be shallow and the risks to diversified portfolios will be manageable. Maintain your long-term view and avoid booking losses.

As for ORSIX, the fund seeks long-term capital appreciation. Under normal circumstances, the fund will invest at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities of small capitalization US companies.

Small capitalization companies are considered to be companies with market capitalizations within the range of those companies included in the Russell 2000 Index at the time of purchase. It may invest up to 20% of its total assets in equity securities of non-US issuers.

Recommended Action: Buy ORSIX