We’ve gotten a lot of bad stock market news lately. So, should you sell? “Heck, no!” counsels Sean Brodrick, editor at Weiss Ratings Daily.

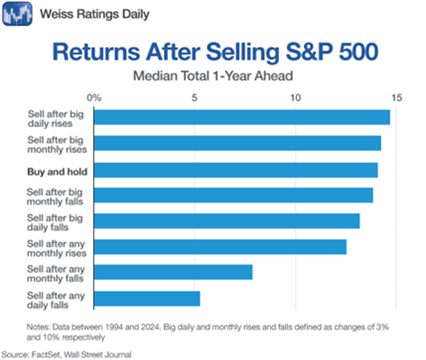

This chart made with FactSet data shows what happens when investors sell after big down days…and under other circumstances. As you can see, the ONLY strategies that beat “buy and hold” are to sell after a big daily or monthly rise. And those who sell after big falls do particularly badly! It’s a case of closing the barn door after the horse is out.

(Editor’s Note: Sean Brodrick is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

Remember, the market ALWAYS has corrections. History shows that, on average:

- 5%+ pullbacks occur more than three times a year

- 10%+ pullbacks occur once per year

- 15%+ corrections occur every other year

- 20%+ pullbacks occur every three to four years

So, my recommendation is, "Don’t Panic." Instead, here are three actions you should consider…

Action No. 1: Look Closely at Your Portfolio

If your positions are getting hammered, is it just because the broad market is going down? Or have circumstances changed for your stocks? One thing we know is interest rates will likely go down. Will that help or hurt the stocks in your portfolio?

If you conclude the drawdown in any particular stock is just temporary, then keep holding it. Only sell a stock IF you think you can make more money investing in something else. And that brings me to the second action.

Action No. 2: Make a Shopping List

In the short term, stocks could go lower. But if your eye is on the longer term — and it should be — lower prices would be a buying opportunity. So, make a list of stocks you want to buy. And raise cash to buy them by selling underperformers you don’t think will bounce.

Action No. 3: Sit Tight, You’ll Be Right

Over the longer term, the market goes up. Here’s a chart of the last 21 years of S&P 500 activity.

The only pullback of real significance is the Great Financial Crisis of 2007-2008. And NO ONE of any repute thinks this current sell-off is anything like the Great Financial Crisis. Even the pandemic pullback looks like a bump in retrospect. And this most recent sell-off barely registers.

Your goal should be to own enough quality stocks that you outperform the broad market. That’s certainly possible. We may not have seen the bottom of this current sell-off yet. But this, too, shall pass. And the next rally will likely be a doozy.