I’ve said for a while that interest rates were the key to utility stock prices short-term. And for at least the past few weeks, the trend has been our friend. While I see two key reasons to be cautious, I still like one of my “Dream Buy” stocks, BCE Inc. (BCE), highlights Roger Conrad, editor of Conrad’s Utility Investor.

Why the caution? First, a number of portfolio stocks have shot up to prices well above my highest recommended entry points. And while Q2 results and guidance are strong, it’s clear the primary catalysts are portfolio repositioning and momentum shifts, rather than what are very encouraging business developments.

(Editor’s Note: Roger Conrad is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

Second, speculation about a Fed pivot has grown because of signs the economy is weakening. And that means rising risk at least some companies will stumble in the coming months.

BCE Inc. (BCE)

Fortunately, the best way to protect your portfolio is to just keep doing what we have been. That’s sticking with quality stocks and moving on from anything weakening as a business.

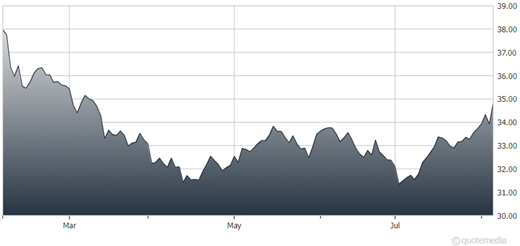

At this point, all of the portfolio holdings reporting so far have proven their strength. That includes BCE, which slipped as low as $31-and-change in early July on what have been shown to be unfounded worries.

The stocks everyone is always tempted to sell are always the underperformers. And judging from questions received at our monthly web chats, several portfolio stocks are currently considered on probation by many investors. BCE has been one.

But stocks only trade at or below “Dream Buy” prices when they’re out of favor with investors. The key to betting on Dream Buy stocks successfully is first knowing why they’re in the doghouse. You then decide whether the reason is ephemeral and will pass, or if it truly undermines the value of the investment.

My general rule is so long as earnings and guidance affirm the strength of the underlying business, a Dream Buy stock will eventually recover. In that case, we’re going to want to stick with it, building positions by buying in incrementally.

Recommended Action: Buy BCE.