If you spent more than 30 seconds on social media Monday, you came across both sides of the panic spectrum. The prophets of doom were saying this was “the tip of the iceberg” or some other cryptic catchphrase. On the other hand, you had the panic buyers, the ones telling you to “load up” on shares of various companies. Ignore both, suggests Tyler Crowe, author of Misfit Alpha.

There is immense temptation to do something during fast-moving events. Fast isn’t a direction, though. Few things are as value-destructive for a long-term investor than to throw their frameworks out the window to chase a couple of percentage points in the market.

Instead, times like this are precisely why stocks have the highest average rates of return over the long haul. We’re getting paid to tolerate this nonsense.

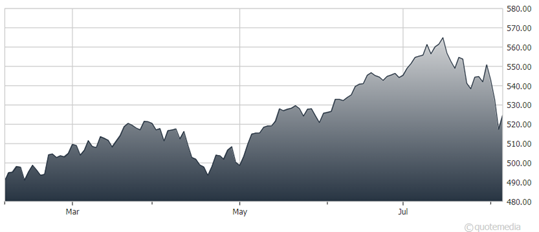

S&P 500 ETF Trust (SPY)

Maybe it’s all those pod shops with their fancy “factor neutral” trades and “pure alpha” algorithms needing to quickly change course when interest rate spreads weren’t working in their favor anymore. Maybe it’s the flash crash of 2010. Or the flash crash of 2013. Or the collapse of Long-Term Capital Management.

Or…well, you get the idea. Whatever the reason may be, here are two things to remember:

- The market ended up in 1987.

- The market ended up in 2020.

The market is an ecosystem. Companies in the market, like individual plants and animals in an ecosystem, will come and go. There will be times of abundance, times of drought and pestilence, purging wildfires, and devastating floods.

And in between these events will be periods of calm and steady growth. All of these come at random intervals, and their appearance (both good and bad) doesn’t always coincide with other factors.

Nature finds a way. As long as humans wake up every morning and try to improve their lot in life, the market will also find a way.

I promise you this. If you intend to keep investing for several decades from today, you will experience dozens of days like Monday and a few more 20%-30% market declines. Stay the course.