In my recent notes and podcast, I covered everything that was finally going UP – in-line with the imminent “Sea Change” I began talking about publicly since late June. Now we are seeing the second piece to the puzzle with Magnificent Seven stocks/Nvidia Corp. (NVDA) underperforming the rest of the market, writes Tom Hayes, editor of Hedge Fund Tips.

Looking at the chart below, you can see that while Mag 7/NVDA became the new “pain trade” since our article on June 20, small caps and much of the rest of the market has outperformed. We expect this to continue for some time – in fits and starts

(Editor’s Note: Tom Hayes is speaking at the 2024 MoneyShow Masters Symposium Sarasota, which runs Dec. 5-7. Click HERE to register)

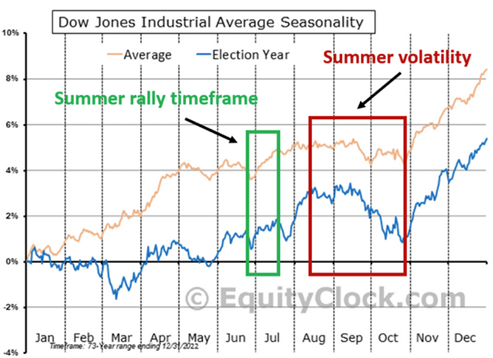

As we said last week, “It would not be surprising to see a little continuation of the ‘Mag 7/Cap-weighted index’ volatility for the end of July.” It is common in an Election Year.

Meanwhile, we recently put out a summary of the monthly Bank of America “Global Fund Manager Survey.” The four most crowded trades it showed are: Long Magnificent 7, Short yen, Short China, Short Small Caps. All four are finally beginning to reverse.