I wanted to give you a look at an opportunity – one based on the “Desert Island Stocks Challenge” I held in early July. Two of our contestants had the same stock pick: Natural Resource Partners LP (NRP), notes Bill Patalon, chief stock picker at Stock Picker’s Corner.

The Opportunity: Natural Resource Partners

Established: 2002

Headquarters: Houston, TX

CEO: Corbin Robertson III

5-Year Dividend Yield Average: 7.14%

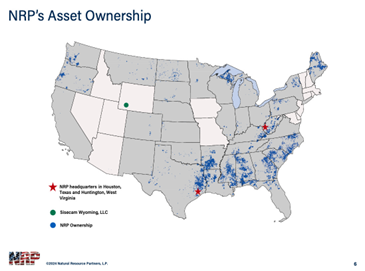

Natural Resource Partners owns and manages 13 million acres of mineral rights. The company has 150 leases with more than 50 lessees. In exchange for leasing the land those mineral deposits are found on to other companies, Natural Resource Partners receives royalty checks that are generally a percentage of the gross revenue received by its lessees.

NRP says the royalties also are “typically supported by a floor price and a minimum payment obligation that protects us during significant price or demand declines.” That means NRP does well as its lessees do well – while also having safeguards if the situation doesn’t go as expected.

In the first quarter, approximately 50% of revenue stemmed from royalties on metallurgical (met) coal – a key ingredient in steel production.

NRP also has a 49% stake in a soda ash business through Sisecam Wyoming LLC, with soda ash being used for glassmaking (for windshields, lightbulbs, and baking dishes), cleaning agents (dish and laundry detergent) and water treatment (pH control).

Recommended Action: Buy NRP.