Medical spending is set to rise as an increasing proportion of the US population crosses the retirement age; spending is projected to grow an average of 5.6% a year through 2032, observes Rida Morwa, income specialist and editor of High Dividend Opportunities.

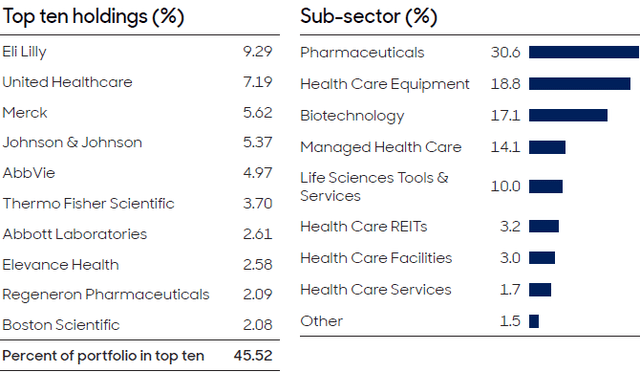

abrdn Healthcare Opportunities Fund (THQ) is a closed-end fund with a focus on US-based biopharma companies. While the fund maintains a portfolio of 116 holdings, its top ten holdings represent ~45% of the assets. THQ is actively managed to realize returns for shareholders.

THQ’s top position is Eli Lilly and Co. (LLY), representing 9.3% of the assets. This company is experiencing strong tailwinds from the soaring demand for its GLP-1 offerings like Zepbound for obesity treatment, and Mounjaro for the treatment of Type II diabetes.

GLP-1 drugs are in serious shortage across the globe, and patients who are prescribed these to manage their conditions are likely to stay on these drugs forever. As such, the ecosystem of companies manufacturing and supplying these drugs is capitalizing on the demand.

THQ’s $0.18/share monthly distribution calculates to a 10.1% annualized yield. YTD, THQ has paid $1.35/share in distributions, 17% from short-term gains, 45% from long-term gains, and 38% from Return on Capital. The higher proportion of capital gains is due to the CEF’s active management of holdings that are currently exhibiting robust fundamentals.

Since its inception in 2014, THQ has distributed $7.88/share in total distributions (~39% of the CEF’s IPO price) to date, while delivering a NAV growth of 13.38%. With the assimilation of THQ and other Tekla healthcare CEFs into Abrdn’s portfolio, we expect a stronger focus on current income and NAV preservation/growth from these securities.

We note that THQ’s monthly distribution was raised by 60% earlier this year, and management is confident about its ability to maintain the increased Stable Distribution Policy for at least the next 12 months, barring significant and unforeseen changes in market conditions. THQ’s discount to NAV is visibly shrinking and lower than its five-year average, accelerated by the fund’s increased monthly distribution.

However, given the tailwinds for the healthcare sector and the expectation of rates heading lower in the coming months, we see THQ’s ~3% discount level as a buying opportunity.