Innovative Industrial Properties Inc. (IIPR) lives up to its name. The company is an innovative Real Estate Investment Trust, or REIT, that leases its 108 real estate assets to 30 cannabis operators in 19 states, advises Marc Lichtenfeld, chief income strategist at Wealthy Retirement.

REITs are known for paying sizable dividends, and Innovative Industrial Properties’ 7% annual yield makes it one of the higher-yielding REITs. Can it continue to pay such a strong dividend, or is management about to harsh investors’ buzz?

As you likely know by now, cash flow is one of the key factors we consider. For REITs, we use funds from operations (FFO) as our measure of cash flow. Innovative Industrial Properties’ FFO has been rising for the past few years. It totaled $232 million in 2023 (up from $211 million the prior year), and I expect it to increase to around $250 million in 2024.

Last year, the company paid shareholders $204 million in dividends for an 88% payout ratio. I’m comfortable with REITs paying out up to 100% of their FFO in dividends, as they are required by law to pay out at least 90% of their earnings.

(Earnings aren’t the same as cash flow or FFO, but because of that obligation, REITs often pay out nearly all of their FFO to shareholders. That’s why we raise our payout ratio limit from our typical 75% for normal stocks to 100% for REITs.)

This year, I expect Innovative Industrial Properties’ payout ratio to rise to 97% – even closer to my limit. It will be worth watching to make sure it doesn’t go over 100%, because if it does, I will have to lower the stock’s dividend safety rating.

However, the company has raised its dividend at least once every year (and 16 times in total) since it began paying one in 2017, so management has shown its commitment to rewarding shareholders.

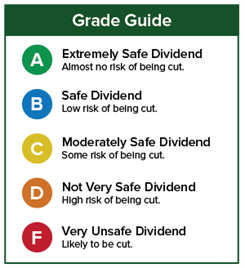

In short, keep an eye on that payout ratio…but for now, there doesn’t appear to be anything too concerning. My dividend safety rating is “A” for IIPR.

Recommended Action: Buy IIPR.