ASML Holding NV (ASML) dropped 12% in a down market for technology stocks on July 17, mainly due to political commentary from both US political parties suggesting tightened restrictions on semiconductor exports. But the Netherlands-based maker of leading-edge semiconductor capital equipment exceeded sales and profit expectations for 2Q24, highlights James Kelleher, senior analyst at Argus Research.

As anticipated, sales and EPS declined by double digits year-over-year. ASML delivered 2Q24 revenue of 4.77 billion euros, down 10% from 2Q23. But that was above its guidance range and Street expectations, and up 20% sequentially. Margins contracted on lower volume, and EPS fell 19% year over year.

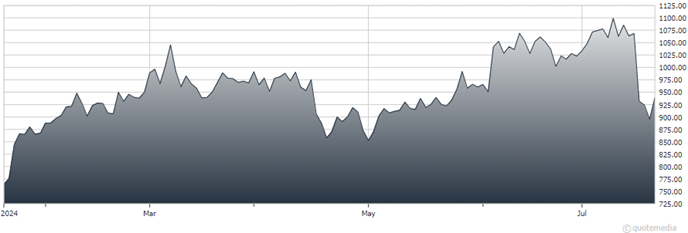

ASML Holding NV (ASML)

Bookings rose 24% annually to 5.6 billion euros, and were up 40% on a sequential basis from a weak 3.6 billion euros in 1Q24; bookings were 9.2 billion euros in 4Q23, at the tail end of a strong 2023. For 3Q24, ASML guided for annual revenue growth to a midpoint of 7 billion euros, although guidance was below the pre-reporting consensus in the 7.2-7.3 billion euro range.

ASML has unmatched leadership in extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography. End markets driving demand include premium-tier edge devices and generative AI applications. The company’s comprehensive product portfolio is aligned with customers’ roadmaps, providing cost-effective solutions in support of all applications from leading edge to mature nodes.

After a challenging 2022, ASML benefited in 2023 from additions to productive capacity. The company’s improved ability to fulfill orders lessened the need for “fast-shipping.” These factors, along with AI and premium-tier device demand and a normalized supply chain, are expected to drive more predictable revenue growth and gradual margin expansion in 2024 and beyond.

We launched ASML at $490 with a “Buy” rating in June 2022, based on growing demand for the company’s advanced semiconductor capital equipment solutions and a healthy industry environment. ASML has blue-chip finances and a strong commitment to shareholder returns.

We believe that the US-traded ASML shares are favorably valued at current prices. We are reiterating our Buy rating and raising our 12-month target price to $1,250 from $1,000.

Recommended Action: Buy ASML.