This past week, the generals continued their retreat on modest capital flows while the troops resumed their rally. The generals (NDX 100) lost -3.98%, while the troops – the iShares Russell 3000 ETF (IWM) – gave up much of their early week gains to finish up 1.74%. The S&P 500 ended the week down -1.97%, with capital outflows outpacing inflows by nearly a 2:1 ratio, notes Buff Dormeier, chief technical analyst at Kingsview Partners.

This “And Then There Were None” market continues to broaden, with the Invesco S&P 500 Equal Weight ETF (RSP) finishing nearly flat (-0.08%), and dividend stocks leading the way higher, with the Schwab US Dividend Equity ETF (SCHD) finishing up 1.85%.

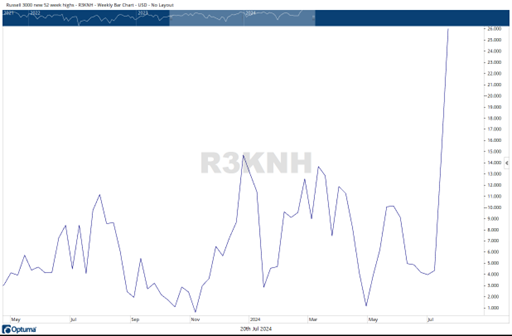

More evidence of market broadening was seen in market breadth. The NYSE Advance-Decline line closed higher for the week, creating a new, all-time, intra-week high. The number of stocks in the Russell 3000 making new 52-week highs reached a new 2024 high.

Both the trends of Capital Weighted Volume and Capital Weighted Dollar Volume pulled back this week but remain in solid uptrends. S&P 500 resistance is at 5,670, with support at 5,440. The troops (IWM) have support between 212 and 210, with resistance at 228.