We might be on the cusp of a global (outside of Japan) “rate tweaking” cycle instead of a “rate cutting” cycle. Meanwhile, foreigners bought a net $46 billion of US notes and bonds in May, according to Treasury data. But it seems that Japan might have sold some Treasuries in order to fund their FX intervention, writes Peter Boockvar, editor of The Boock Report.

After the ECB meeting last week, Bloomberg News reported that “ECB policymakers are increasingly wondering if they may only be able to cut interest rates once more this year, according to people familiar with the matter. With inflation pressures still lingering, officials are becoming less confident that a path for two further reductions is realistic, and don't want investors to assume that a move in September is a done deal, said the people, who declined to be identified because deliberations are private.”

That said, the swaps market is currently fully pricing in two more rate cuts. Members Villeroy and Simkus also said after the meeting that they agreed with that assumption. Bonds yields were little changed in the two days following the meeting, as was the euro currency.

(Editor’s Note: Peter Boockvar is speaking at the 2024 MoneyShow Toronto, which runs Sept. 13-14. Click HERE to register)

After selling a net $37.5 billion in Treasuries in April, Japan sold another $22 billion in May, taking their total holdings to $1.1 trillion. That’s still the number one spot among foreign holders, but the least since November. China sold $2.4 billion worth of Treasuries, and their holdings are hovering around the lowest since 2009. It’s not a coincidence that their holdings really went south soon after Russian invaded Ukraine and the EU and US froze half of Russia’s central bank reserves.

Purchases coming from the Cayman Islands led the buying, $17.1 billion worth, and are typically hedge funds domiciled there. Canada added $16.3 billion and the UK $13.1 billion. The UK can be anyone, including banks, hedge funds and countries using a UK bank to transact.

Bottom line: While “foreigners” in totality continue to purchase US Treasuries, the percentage ownership of them continues to fall. They own about 30% of US marketable debt now versus 50% 10 years ago.

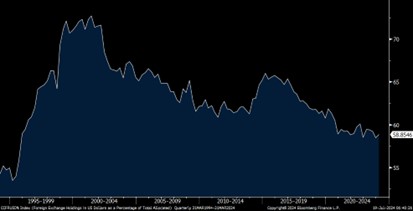

FX Holdings in US dollars as % of Reserves

As part of this, the percentage of foreign reserves that hold US dollars as of March was at the lowest level since 1996. Gold is picking up some of that slack.