The Prudent Speculator follows an approach to investing that focuses on broadly diversified investments in undervalued stocks for their long-term appreciation potential. Does that mean we build portfolios of 20 stocks...30...? More like 50 and up. We like stocks. And we like a lot of ‘em. One is Archer-Daniels-Midland Co. (ADM), notes John Buckingham, editor of The Prudent Speculator.

We don’t rely nearly as much on “how many” as we do “in which,” but we tend to invest in far more names than most. This expansive diversification, we find, potentially serves us well in two ways. We can further minimize the risk of individual stock ownership, while maximizing the likelihood of finding the truly big winners among the undervalued masses

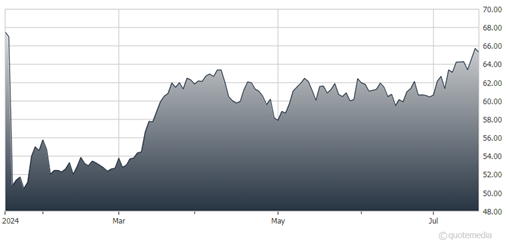

Archer-Daniels-Midland Co. (ADM)

ADM is one of the largest global agricultural processors and food ingredient providers. As a refiner of various agricultural commodities like soybeans and corn, we acknowledge the cyclical and often volatile nature that characterizes ADM’s businesses. Indeed, lower pricing and execution margins, as well as lower mark-to-market timing impacts were behind a drop in adjusted EPS to $1.46 in Q1, versus $2.09 in the year-ago period.

Still, input and manufacturing costs improved, while we think trends supporting long-term demand growth in agriculture remain intact. Shares have recovered some of the ground lost following a probe by regulators into the company’s accounting earlier this year, but we believe they remain in bargain territory, trading for 11 times EPS expected this year and next. Also, the dividend yield is north of 3% and management repurchased over $1 billion of stock in the latest quarter.

Recommended Action: Buy ADM.