Technology stocks had a really bad day Wednesday as political wrangling sent professional money managers scurrying to close positions in their 2024 winners. Don’t follow their lead, writes Jon Markman, editor of Digital Creators & Consumers.

Pros do this all of the time. They believe they can accurately rotate between stocks, and from one sector to another, catching the upswing in the new leader while avoiding the downdraft in the previous champion. Pros are fooling themselves. They have no history of success.

Longer-term studies from S&P Global show that an astounding 94% of money managers fail to keep pace with their unmanaged benchmarks. In fairness, this is a difficult task because pros also have to manage risk.

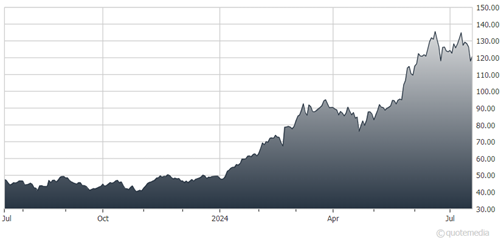

Members of various Markman Capital Insight services know that some positions have remained in our portions for a decade. Undoubtedly, shares of Nvidia Corp. (NVDA) happily make up huge portions of your net worth. Longer-term gains of 25,763% led to this, and that’s cool.

Nvidia Corp. (NVDA)

Pros can’t hold onto winners because they have to manage against overconcentration. However, pros are now rotating from winning shares of Nvidia, Taiwan Semiconductor Manufacturing Co. (TSM), and Arista Networks Inc. (ANET) into losers like Intel Corp. (INTC), GlobalFoundries Inc. (GFS), and Cisco Systems Inc. (CSCO). At the session highs on Wednesday, these stocks were up 8.2%, 13.8%, and 2.8%, respectively.

Many pros say Nvidia, TSM, and Arista have become too expensive, and that the latter represent great “value.” Pros are delusional. The best longer-term investors buy shares in great businesses with durable competitive advantages. Intel, GlobalFoundries, and Cisco have underperformed because their businesses are being disrupted by Nvidia, TSM, and Arista Networks.

Moreover, the cause of the tech weakness on Wednesday was a pair of Bloomberg political stories. The first was a report that the Biden Administration is considering tougher trade restrictions on semiconductor exports to China. Separately, former President Trump opined that Taiwan should pay the US government for protection from Chinese aggression. In other words, two candidates for president were trying to score political points.

I’m not saying bulls get a mulligan on Wednesday. But some perspective is warranted. Occasionally, there will be selloffs, and that’s fine. Some giveback was inevitable.

We are monitoring closely, however, and we are committed in the near term to buying our digital transformation stocks into weakness.