Biases are part of the human condition, and our latest entry to the Timely Ten, the Unum Group (UNM), has been in the negative bias camp for quite some time. Now that it has risen up in the internal cash flow rankings, it is squarely on our radar screen. This is why we do the work, suggests Kelley Wright, editor of IQ Trends.

Clearly the market is on steroids. The market is making a lot of assumptions and betting on them. No cycle or trend persists for perpetuity, but it doesn’t appear that that market is thinking about that at the present moment.

(Editor’s Note: Kelley Wright is speaking at the 2024 MoneyShow/TradersEXPO Orlando, which runs Oct. 17-19. Click HERE to register)

A lot of you have amassed quite a bit of paper capital gains and are wondering if it is time to take some money off the table. Only you can answer that question based on your personal circumstances and situation. What I do know is if you sell and the market continues higher, you will have regrets. If you don’t sell and the market declines, you will have regrets.

The salient question, I believe, is what outcome are you best prepared to live with? On one hand you may miss out on some additional capital appreciation and dividends, and you will have a taxable consequence to deal with. On the other hand, you may see years of capital gains disappear that you were planning on tapping for current/future cash needs.

I know, this is the question that keeps you up at night, and it stings if you feel you made the wrong decision. Good luck.

As for UNM, it is the largest provider of disability insurance products in the United States and the UK. The company’s other products include life insurance, group benefits, and related services. The company has four operating segments: Unum US; Unum International; Colonial Life; and the Closed Block (Individual Disability and Group and Individual Long Term Care).

Unum is well capitalized with a 440% risk-based capital ratio (RBC), up from 415% at year-end. Management expects RBC to stay in the 415%-430% zone this year, which is a healthy level and above the 350% target. Unum also has $1.4 billion of holding company liquidity, $900 million above its long-term target.

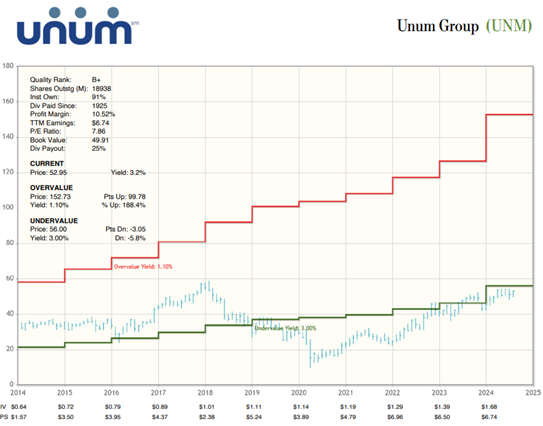

Strong earnings provided for $123 million of Q1 buybacks, which is on pace to meet its $500 million full-year target. The dividend was increased to $1.68, and the current yield is about 3.2%.

Recommended Action: Buy UNM.