Johnson & Johnson (JNJ) reported second-quarter sales increased 4.3% to $22.4 billion, with net income falling 12.8% to $4.69 billion and EPS declining 5.9% to $1.93. Excluding special items, adjusted EPS increased 10.2% to $2.82, notes Ingrid Hendershot, editor of Hendershot Investments.

During the quarter, Johnson & Johnson generated about $7.5 billion in free cash flow and returned $3 billion to shareholders through dividend payments. Johnson & Johnson deployed $17 billion in strategic inorganic growth opportunities during the quarter. The company ended the quarter with about $25 billion in cash and investments and $41 billion in debt on its AAA-rated balance sheet.

During the conference call, management provided an update on talc litigation. In conjunction with plaintiff attorneys, Johnson & Johnson has committed $8 billion over 25 years to resolve 99.5% of the lawsuits.

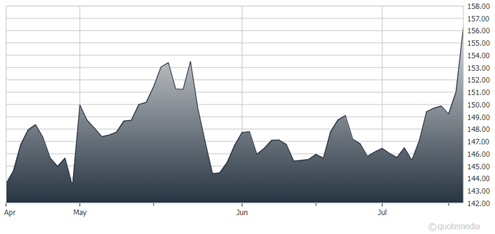

Johnson & Johnson

Plaintiffs have until July 26 to vote on the proposed settlement. If 75% of plaintiffs approve the settlement, Johnson & Johnson will move ahead with plans to split into two entities with the talc liability-holding entity filing for bankruptcy.

Johnson & Johnson updated its 2024 guidance to reflect improved performance and the impact of recent acquisitions of Shockwave Medical, Proteologix, and NM26 Bispecific Antibody. Reported 2024 sales are expected to increase 4.7% to 5.2% to between $88 billion and $88.4 billion. Operating margins should decline 120 basis points due to the recent acquisitions and adjusted EPS should inch ahead 0.5% to 1.5% to between $9.97 to $10.07.

Management expects sales growth for Innovative Medicine will slow during the second half of the year on the anticipated entry of STELARA biosimilars and continued uptake from recently launched products. MedTech sales growth is expected to accelerate in the back half of the year on a recovery in contact lenses, further expansion into high-growth segments, including the integration of its Shockwave acquisition, and continued growth of new products.

Recommended Action: Buy JNJ.