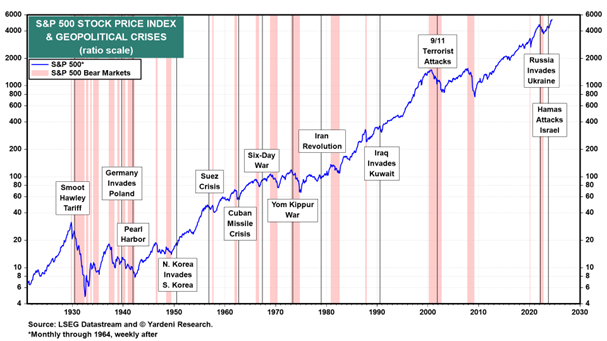

We've previously written that our number one concern for the stock market is unsettling domestic and global political turmoil. The attempt to assassinate former President Donald Trump on Saturday heightened anxiety about political violence at home as the November elections approach. Then again, the stock market has a history of tuning out domestic and global political shocks, writes Edward Yardeni, editor of Yardeni QuickTakes.

On the global stage, the violence of the wars between Ukraine and Russia and in the Middle East seems to be escalating. But political crises more often than not turn out to create buying opportunities for stock investors.

Meanwhile, we recently raised our yearend target for the S&P 500 to 5,800 from 5,400. We are still targeting 8,000 by the end of the decade.

The stock market seems to be discounting our Roaring 2020s scenario faster than we expected. We've been among the most bullish investment strategists since November 2022, but not bullish enough. The bull market might continue to achieve our targets ahead of schedule.