For the past few weeks we’ve written about the narrow, divergent market environment. We've said that it's not necessarily bearish (these things can keep going for many weeks or even months), but that it does raise the risk of a sharp character change – be it a general selloff or a sharp rotation. The latter may be happening now. I like Guardant Health Inc. (GH) here, notes Mike Cintolo, editor of Cabot Top Ten Trader.

Last week saw some truly extreme action. The lagging broad market rallied sharply (the iShares Russell 2000 ETF (IWM), rose 2.9% on Thursday, while breadth was hugely positive) even as the red-hot Nasdaq 100 fell 2.2% and other growth measures sagged.

When it comes to an overall market view, we’re not going to make any grand declarations here. It has been just one-plus day of this sort of action, so we can’t conclude that it’s going to carry forward for weeks to come. It’s possible the rotation is halted in its tracks, or maybe we simply see the buying pressures broadening out.

Guardant Health Inc. (GH)

But the odds do favor a short-term peak in some of the hot names and a short-term low in the broad market. Beyond that, it’s too early to say. It’s possible the rotation continues, it stops, or (if all of us are lucky) the buying pressure simply broadens out. In the meantime, we continue to advise taking things on a stock-by-stock basis, booking partial profits when they appear and staying flexible on the buy side.

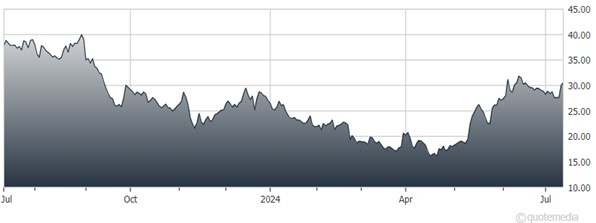

As for Guardant, the company provides cancer blood tests and analytics for clinical and research use, and the firm maintains research partnerships with large biopharmaceutical companies. The stock had a very low-volume pullback after its huge-volume, eight-week rally, tagged its 10-week line, and then bounced on heavier volume.

Hold on if you own some, and if not, we’re okay nibbling here.

Recommended Action: Buy GH.