The new world of single-stock, covered call ETFs is the latest step in the long line of ETF innovations. One to consider is the YieldMax AAPL Option Income Strategy ETF (APLY), which its sponsor launched in July 2023, notes Tim Plaehn, editor of The Dividend Hunter.

The first batch of ETFs tracked popular stock market indexes. The S&P 500 ETF Trust (SPY) started trading in the US in 1993. The Select Sector SPDRs began trading in 1998. Now, if you find an index, you can almost assuredly find an ETF that gives you investment exposure to that index.

(Editor’s Note: Tim Plaehn is speaking at the Income, Growth, & Value Virtual Expo, which runs Sept. 17-19, 2024. Click HERE to register)

The year 2013 saw the arrival of ETFs that used covered call options strategies to boost income and pay attractive dividend yields. While this type of fund has been around for more than a decade, the category has taken off in the last couple of years. New option strategy funds are being launched every week, and assets in these funds have grown tenfold in the last few years.

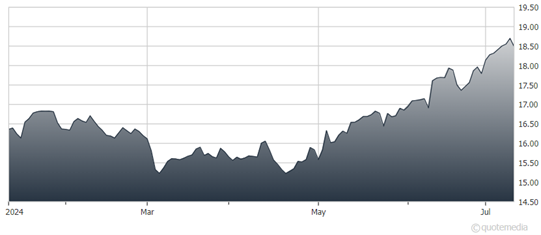

YieldMax AAPL Option Income Strategy ETF (APLY)

The newer breed of covered call ETFs is not satisfied with the high single-digit yields of the older generation. There are funds offering yields of 20% up to 60%. The challenge for investors is to determine if the employed option strategy will work or will work to destroy an investor’s portfolio.

YieldMax now has 23 ETFs covering 23 popular stocks. KURV funds offer six single-stock covered-call ETFs on popular stocks like Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Netflix Inc. (NFLX). The YieldMax funds have especially caught the attention of investors with distribution yields that have exceeded 100%.

Keep in mind: New option strategy and single-stock covered call ETFs are launched every week. It takes four to six months of track record to see how well each fund performs. Investing in these funds requires more information than just picking them by quoted yields.

Recommended Action: Consider APLY.