Federal Reserve Chair Jerome Powell is juggling inflation and the labor market like a pro. He claims the labor market is back in balance, but it’s not that simple. The nuances are what make this interesting. Let's dig in, writes Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Powell says the labor market has cooled, but it’s still strong. Job creation is slowing down, hinting at a return to pre-pandemic vibes. “We need to see more good inflation data,” Powell remarked this week before Congress, casually mentioning they’ve had one solid inflation reading and one that’s “pretty good.” Good enough? We’ll see.

Getting inflation down is Powell’s top game. The Fed’s moving cautiously with rates, needing more positive data to boost their confidence. “More good data would strengthen our confidence on inflation,” he added.

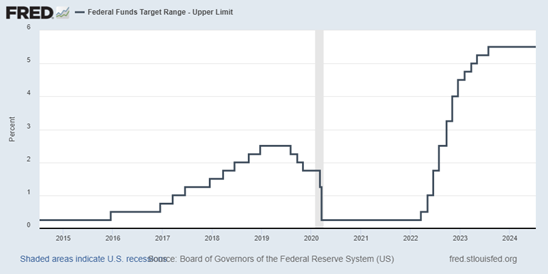

Federal Funds Rate Target (Upper Limit)

Translation: Hurry up and wait.

If you were hoping for clues on when the Fed might cut rates, Powell’s not your guy. “Today, I'm not going to be sending any signals on the timing of future actions,” he said.

Powell is proud of the US economy, noting it’s doing better than its global peers, expanding at a solid pace. But don’t get too comfortable. Reducing restraint too late or too little could mess things up.

Other quotes of interest were...

• “The most recent inflation readings, however, have shown some modest further progress, and more good data would strengthen our confidence that inflation is moving sustainably toward 2 percent.”

• “At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face.”

With the September FOMC decision not far off, everyone’s watching the Fed. Rate cuts or cautious steps? We’ll know soon.