Italy closed the last of its operating nuclear reactors in 1990, following a 1987 post-Chernobyl referendum. But earlier this year, Enel SpA (ENLAY) and Ansaldo Nucleare forged an agreement to develop new nuclear reactors, with support of the country’s Ministry of Environment and Energy Security, notes Roger Conrad, editor of Conrad’s Utility Investor.

Enel’s Endesa unit operates several reactors in Spain, which at this point has a plan to phase out nuclear energy by 2035. But like Italy, the country is now reconsidering its options. And as the largest power producer in both countries, the company is poised to capture what business emerges.

(Editor’s Note: Roger Conrad is speaking at the 2024 MoneyShow/TradersEXPO Orlando, which runs Oct. 17-19. Click HERE to register)

Enel’s primary CAPEX focus is new wind, solar, and storage, with operations in 29 countries. It will spend EUR12 billion of its 2024-26 CAPEX plan on adding 11 gigawatts of new solar (53 percent), wind (26 percent), and batteries (19 percent) globally. That’s just slightly less than the 12.8 GW installed in 2020-23 and at a lower projected cost.

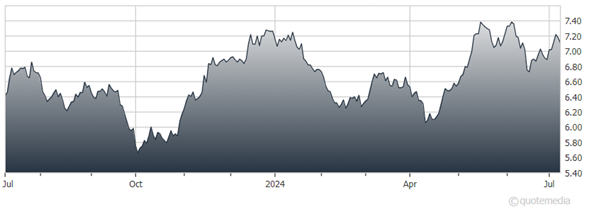

Enel SpA (ENLAY)

In contrast to new nuclear, these projects can be sited, permitted, funded, and built within 12-18 months, enabling Enel to lock in costs and project returns. Last month, the company opened a 93-megawatt solar facility in Victoria, Australia — where plans to shutter coal plants have launched a building boom — as well as an 87 MW "solar plus storage" facility in Italy.

Moody’s has boosted the outlook for Enel’s BBB+ credit rating to stable from negative. That’s the latest sign systematic debt reduction of the past few years is paying off. And asset sales targeted at EUR20 billion have been largely met without cutting meaningfully into cash flow.

Enel generates roughly 22 percent of EBITDA from South America, particularly Brazil, Colombia, and Chile, through its 64.93 percent-owned unit Enel Chile (ENIC). That exposure accounts for the discounted price to other major European electrics, due to currency volatility. But long-term it offers the upside of faster-growing markets.

The French Right’s threat of a post-election “Frexit” energy policy no longer seems likely. But however European energy policy evolves, Enel will continue to benefit from its strong generation position, even as it capitalizes on surging demand from data centers in Italy and Spain.

Recommended Action: Buy ENLAY.