Microcap stocks are an under-covered segment of the market. That also means that they offer some of the very best investment opportunities. It’s where Peter Lynch and Warren Buffett would go fishing if they only could. Alas, the size of their portfolios precludes them from doing just that. One I like is Lakeland Industries, Inc. (LAKE), highlights Nicholas Vardy, editor of Microcap Moonshots.

Lake manufactures and sells industrial protective clothing and accessories for the industrial and public protective clothing market. The Company manufactures firefighter protective apparel and accessories, high-end chemical protective suits, limited-use/disposable protective clothing, durable woven garments, high-visibility clothing, and gloves and sleeves.

Its products are sold globally by its in-house sales teams, customer service group, and authorized independent sales representatives to a network of over 2,000 safety and industrial supply distributors.

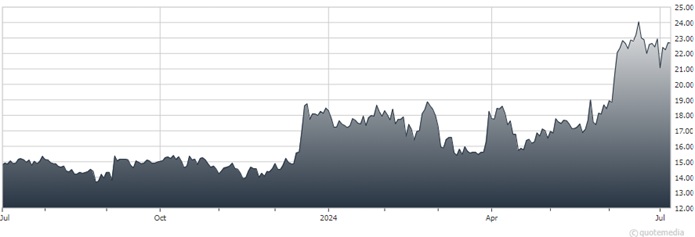

Lakeland Industries Inc. (LAKE)

Rating: 90/100

Quality: 93

Value: 42

Momentum: 86

I like these kinds of boring businesses. Nothing in their current financial statements suggests any problems with company health, bankruptcy risk, or earnings manipulation. Lakeland also qualifies for two growth and momentum-related screens.

Note the high quality score. The low ranking on valuation is a drag on this stock’s prospects.