Equity investors enjoyed the first half of 2024, as the S&P 500 logged a double-digit gain. Historically, that type of performance has been a precursor to further increases in stocks by the end of the year. Meanwhile, NetApp Inc. (NTAP) recently conducted its annual investor meeting in New York. The company provided several encouraging three-year growth targets there, writes John Eade, president of Argus Research.

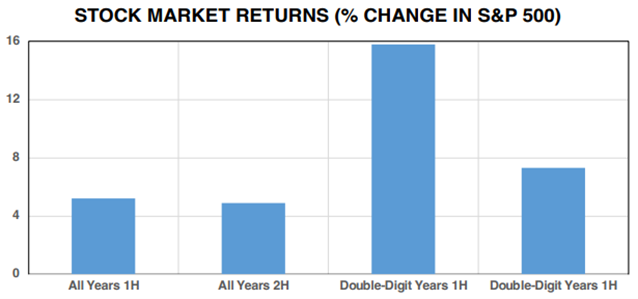

Our study of seasonal stock market returns identified 16 first-half periods since 1980 during which the S&P 500 rose at least 10% (in fact, the average gain was 15.8%). The average S&P 500 return in the second half of those years was 7.3%.

How do these compare against the overall averages? Well, for all years, first-half gains averaged 5.2% and second-half gains averaged 4.9%. So, not bad.

Going back to our double-digit first-half years, the best performance came in 1986, when the market roared out of the starting gate and soared 25.5%. The best second half from that group was in 2012, when the S&P 500 tacked on another 17%.

Still, there are no guarantees that stocks will continue to climb in the second half. In three of the 16 years, the S&P 500 lost ground, for a winning percentage of 81% -- which isn’t bad. One of those years really stung though. That was 1987, when stocks plunged 23.5% during a period that included the Great Crash.

This time around, stocks may benefit from positive economic and earnings trends and the possibility of lower interest rates. The upcoming presidential election is a wild card, though, and could add uncertainty as the first Tuesday in November approaches.

As for NTAP, management is targeting a mid-to-upper-single-digit increase in revenue and double-digit non-GAAP EPS growth. NTAP is also working to deliver 30%-plus non-GAAP operating margin and a free cash flow margin of 20%.

Management stressed that the company is focused on large and growing markets in the flash and block segments, mentioning that the company is “the agent of disruption in this market” when referring to block storage. We think the company can reach its targets. Our 12-month target price on the NTAP shares is $140.

Recommended Action: Buy NTAP.