Did you watch that debacle, I mean, that debate last week? The current president’s performance was, well, how do I put this kindly…a disaster. Meanwhile, even the most generous fact-check on the former president was, shall we say, problematic. As for our money, the most important question here is “How will the presidential race affect markets going forward?” explains Jim Woods, editor of Successful Investing.

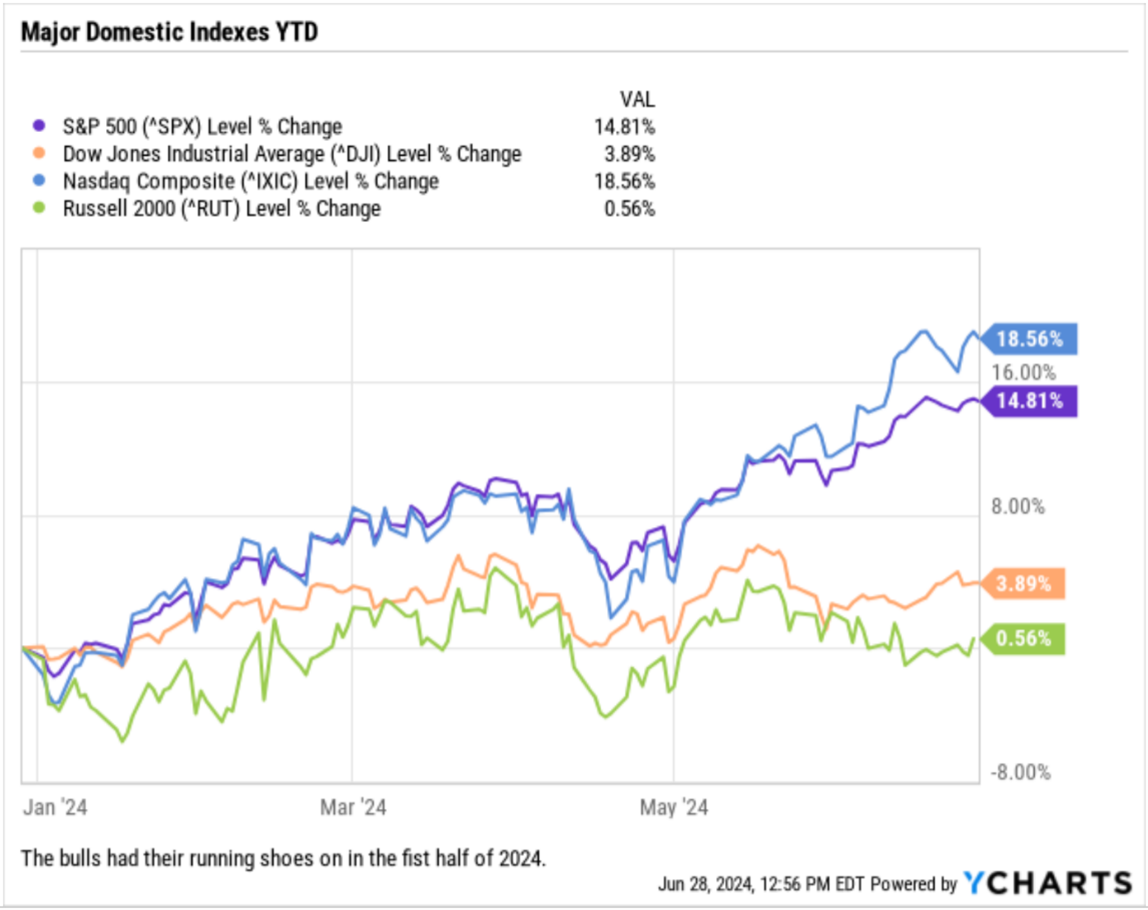

This is indeed one of the points of uncertainty that we face now that we've closed out the first half of 2024 and are moving into the second half, and it is one of many points of uncertainty that markets are looking to see resolved. Looking at the chart here of the major indices, you can see the bulls have very much been in command in 2024.

The bullish mantra of solid economic growth, falling inflation, sooner-rather-than-later Fed rate cuts, and Artificial Intelligence (AI) enthusiasm fueled the upside in markets in the first half of the year. How these mantras fare in the second half is much more important than the election, although they all will be points of uncertainty that need to be resolved for the bulls to keep running.

As for our unique measure of the markets, last week we saw a very modest uptick in the Domestic Fund Composite (DFC) (+0.25%) and a nearly equally modest downtick in the International Fund Composite (IFC) (-0.21%). Both the DFC and IFC remain firmly above their respective 39-week moving averages, and both the Domestic and International Plans remain comfortably in “Buy” status. That means your money should be in it to win, and according to the portfolio(s) that most serve your money’s needs.

So, what do I anticipate will happen in the second half of 2024? That’s a question I’ve been getting of late, and it’s one that has a lot of Wall Street pros biting their nails. I don’t know, and neither does anyone else, because humans aren’t omniscient.

However, what we can do is take the data we have now, impose our best analysis on the numbers and sentiment and, most importantly, put our money to work in what we think will give it the greatest chance of delivering robust upside while also having our rules in place to protect us from the downside.

This is the formula for successfully investing your money, regardless of who the president is, which party controls Congress and which candidate you support. Because politicians come and go — but a rational approach to growing your money must always be firmly rooted in the service of your self-interest.