The dollar just rose to its highest level since last year as the Federal Reserve breaks with other central banks by keeping interest rates elevated, giving global investors an incentive to move cash to the US to capture higher bond yields. Meanwhile, I like Neo Performance Materials Inc. (NOPMF), whose shares just rose 12% in a week, notes Carl Delfeld, editor of Cabot Explorer.

You may be tired of hearing that the S&P 500’s solid gain in 2024 is being driven by a handful of mega-cap tech stocks. The top 10 stocks now represent a staggering 36.8% of the index’s total value. That’s the highest concentration since September 2000.

Less noticed is that the Magnificent Seven also spent $208 billion on buybacks last year. However, Amazon.com Inc. (AMZN) and Tesla Inc. (TSLA) are not buying back much stock. Rather, Amazon is paying off debt and building for AI, and Tesla is focused on financing growth.

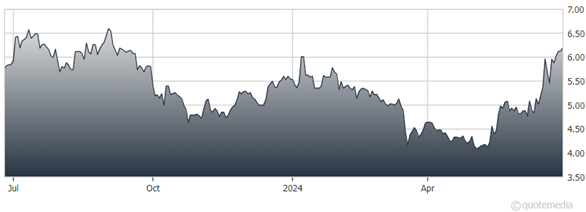

Neo Performance Materials Inc. (NOPMF)

Overseas, China’s financial markets are anemic. When e-commerce giant Alibaba went public in 2014, the company raised $25 billion, the biggest listing ever at the time. So far this year, there has been only one Chinese IPO in the US – by the electric vehicle maker Zeekr. IPOs in China have also been weak, with less than $3 billion being raised this year, according to data from Dealogic.

Meanwhile, NOPMF shares continued their momentum, up big on the heels of an upgrade by leading mining and metals broker Stifel and the announcement of a strategic board review to maximize shareholder value. Neo remains a value buy due to its strategic importance, dividend, and a strong cash position coupled with low debt.

Recommended Action: Buy NOPMF.