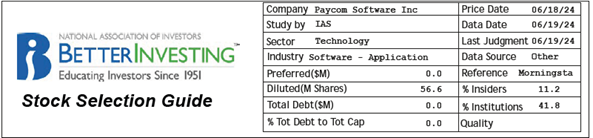

Shares of Paycom Software Inc. (PAYC) have performed poorly over the past couple of years largely due to a P/E that has contracted to 23 compared to above-100 just three years ago. But strong cash flow, zero debt, continued innovation, and a loyal customer base suggest considerable upside potential from this depressed level, explains Doug Gerlach, editor of Investor Advisory Service.

Founded in 1998, Paycom offers Software- as-a-Service (SaaS) focused on payroll and human capital management (HCM) for small and mid-sized businesses employing between 50 and 10,000 workers. Accessible in the cloud and by mobile apps, the software provides a range of functions with no setup and no long-term contracts.

A couple of years ago, Paycom’s revenue was growing at a 30% clip due to easy comparisons against depressed results in the early Covid period. Growth began decelerating from the mid-to-high-20s in the first half of 2023 to the low 20s in the third quarter and high teens in the fourth.

The company projects low-double-digit growth for 2024, consistent with results in this year’s first quarter. It projects the second quarter to be the trough for the year. The company doesn’t provide EPS guidance, but combining its EBITDA guidance with a reduced share count suggests mid-single digit EPS growth in 2024.

Wall Street consensus calls for low-teens revenue growth and mid-teens EPS growth in 2025. Supporting this intermediate-term optimism, Paycom reported an acceleration of new sales in recent months.

Paycom continues to innovate. GONE, its new product for automating time-off requests, has gotten off to a strong start. The company has also expanded into other countries, starting with US-based customers having operations overseas. Paycom has launched native payroll applications in Canada, Mexico, and the UK.

We model Paycom’s future as if the 2024 slowdown becomes the new normal with low-double-digit revenue growth. Share repurchases from its strong free cash flow and margin improvement could offer 13% EPS growth. Triple digit P/E ratios will not return. We modeled the high P/E as 26, 2x its estimated 13% EPS growth. The low P/E of 19.5 is 1.5x EPS growth. These are reasonable for a company with 98% recurring revenue.

On these assumptions, the potential annual total return exceeds 17% and the Upside-Downside ratio is 7.5. Paycom is passionate about product development and its customers’ return on investment. Perhaps that’s why its Net Promoter Score is a strong 62% versus 31% for Workday and negative scores for Paychex, Paycor, and Paylocity. This gives us further confidence that Paycom can rebound and become a solid investment with the potential for an upside surprise.

Recommended Action: Buy PAYC.