The financial media and some so-called Wall Street gurus are banging the drum that the Artificial Intelligence (AI) trade is being overpriced and way ahead of expectations about what this once-in-a-lifetime secular theme will deliver to investors. But I think this round of consolidation in the leading AI names is highly constructive, advises Bryan Perry, editor of Dividend Investing Weekly.

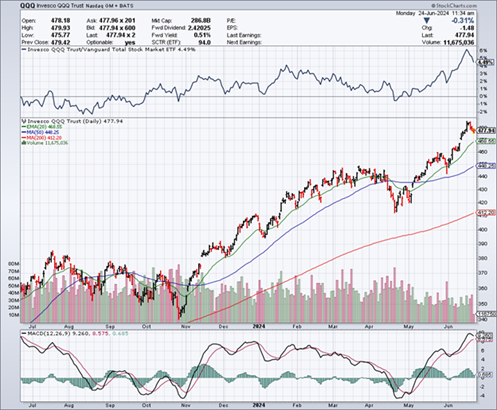

With the recent AI-led tech rally hitting pause last week and bond yields falling on softer inflation data in early June, the recent surge in mega-cap AI growth stocks to new highs collided with overbought technical levels to cause some short-term profit taking.

Big parabolic moves higher leave huge gaps underneath that result in more volatile pullbacks. Those create doubt in the minds of investors about the longevity of a stock’s uptrend. Quite frankly, I am pleased to see how the top 10 AI stocks have been trading in the past week, after some fear-of-missing-out (FOMO) moves fueled by massive options trading and leverage.

Hot growth stocks take the stairway up to new highs, then the elevator back down to rising support trendlines. The moves up and down can be stunning. But during this garden-variety pullback for the market, there were some key developer conferences that fortified the message AI bulls have been shouting from the hilltops — this is the biggest advance in technology of all time.

The Alphabet I/O Conference held May 14, the NVIDIA GTC Conference held the week of May 22, the Microsoft Build Conference held May 24-25, and Apple’s Worldwide Developers Conference from June 10-14 collectively planted the flag for the next leg up for the biggest AI-centric stocks.

This past week saw some very constructive technical back-and-filling price action for the best of breed AI stocks that fall into several categories — Graphics Processing Units (GPUs), Application Programming Interfaces (APIs), generative AI software, memory storage, hard drives, liquid-cooled servers and end-user products. We now are on the cusp of a global refresh cycle for PCs and wireless devices to include AI functionality.

Shares of NVIDIA Corp. (NVDA), Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL), Apple Inc. (AAPL), Meta Platforms Inc. (META), Broadcom Inc. (AVGO), Micron Technology Inc. (MU), Qualcomm Inc. (QCOM), Super Micro Computer Inc. (SMCI), Dell Technologies Inc. (DELL), Oracle Corp. (ORCL), Applied Materials Inc. (AMAT), and Western Digital Corp. (WDC) are my favorite names to own and trade.

Recommended Action: Buy AI Stocks.