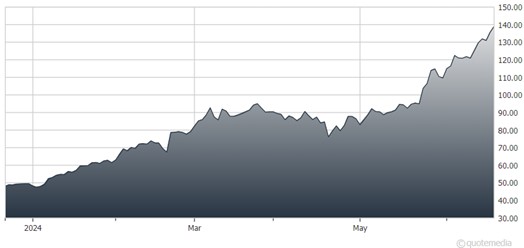

Nvidia Corp. (NVDA) has been all the rage – and justifiably so. Since NVDA reported its Q1 2023 earnings and disclosed the huge demand for its AI chips, the stock has gone straight up. But what may go even higher in the short term can go a lot lower in a blink, counsels Tom Hayes, editor of Hedge Fund Tips.

NVDA is now worth $3.3 trillion. Revenues up 4x, margin expansion, etc. – it’s everything anyone could ever wish for. And as the stock went up, bulls exclaimed it’s getting “cheaper” because as earnings grew, the multiple came down.

But now we have a different landscape – one of decelerating growth. Quarterly revenue growth has gone from 88% to 34% to 18% and is on its way to single digits. Now the multiple is re-accelerating into slowing growth. Next quarter revenue growth guidance is just 7%.

Nvidia Corp. (NVDA)

All of the marginal buyers are in – sucking the last few retail buyers in with the lure of a split. History suggests a short-term bump after a split as we are seeing, but now institutional investors have a vast pool to distribute their shares in coming months. As the saying goes, “when the ducks are quacking, feed them.”

This does not change the fact that Nvidia is a great business with a great leader – which will play a role in the advance of AI technologies and productivity. It’s just going to be a heavy lift that it retains a perception of greater value than Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), or the entire German stock market capitalization (where it trades now).

NVDA is still a semiconductor company, which has never been a secular business – it’s cyclical. Always has been, always will be. As for 70%+ gross margins, as Bezos famously said, “your margin is my opportunity.”

NVDA has not cured cancer. There will be more and more competition going forward. Intel Corp.’s (INTC) Gaudi 3 is 50% faster than NVDA’s H100 and 40% more energy efficient. Advanced Micro Devices Inc. (AMD) is gunning for them. The game is just beginning and NVDA will be forced to share the pie as no buyer wants to be beholden to one company.

Remember: “Price is what you pay, value is what you get.” Caveat emptor at these levels.