Metals are finding their silver lining as silver is leaping and breaking out after wild swings of volatility. Meanwhile, copper continues to be the industrial metal that could lead shortages in the years ahead. We know that many commodities are in a super cycle and copper may be the best example, notes Phil Flynn, author of the new Manic Metals Report.

By popular demand, I’m introducing the Manic Metals Report. Many of my clients have been clamoring for me to put together a report like this. While I’ve been noted for my energy commentary for many years, I have a lot of experience on the metals side as well. As a futures broker since 1983, I’ve had a lot of experience trading metals, physical as well as futures.

In this environment, value-wise based on the price of gold, silver is still cheap. We are also seeing some signs of turning in some industrial metals that have been stymied by weak manufacturing data out of China (even as we’ve gotten encouraging industrial numbers in the US).

Rick Mills of Ahead of the Herd did a great piece on copper recently. He wrote that a “commodity super cycle” is a period of consistent price increases lasting more than five years, and in some cases, decades. The Bank of Canada defines it as an “extended period during which commodity prices are well above or below their long-run trend.”

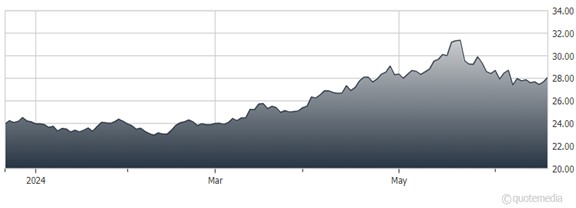

United States Copper Index Fund (CPER)

He pointed out the reasons why copper fits that narrative. He said that “Copper is one of the most important metals, with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping), power generation/ transmission, and electronic product manufacturing. In recent years, the global transition towards clean energy has stretched the need for the base metal even further.”

The copper deficit will be so large, The Financial Post stated, that it could hold back global growth, stoke inflation by raising manufacturing costs, and throw global climate goals off course.

Two reasons identified by Sprott: “Developing a new copper mine is lengthy and expensive, often taking over a decade from exploration to production; and the mining sector has seen long periods of underinvestment, when low copper prices meant reduced exploration budgets and fewer discoveries.”

So, as we head toward the end of the week, it looks like most of the metals are breaking out to the upside. Gold is lagging. But it’s probably a good time to start putting on some strategies – maybe a combination of futures and options to take advantage of this move to the upside.

Subscribe to the Manic Metals Report here...